Trusted Massachusetts Cannabis Banking Solutions

Marijuana Banking in Massachusetts

2025 Cannabis banking in Massachusetts: Current rules and regulations

Cannabis is legal in Massachusetts for both medical (2012) and adult-use (2016), with retail sales beginning November 20, 2018. See the legalization timeline in the CCC’s history/background materials and the 2016 law (Chapter 334) following voter approval of Question 4 (2016).

Taxes (no change in 2025): Adult-use purchases are subject to 10.75% state excise tax, 6.25% state sales tax, and up to a 3% local option tax (medical cannabis remains tax-exempt).

Host Community Agreements (HCAs) & community impact fees: The 2022 reform law (Chapter 180) gave the Cannabis Control Commission (CCC) explicit HCA oversight and guardrails on community impact fees. The CCC has rolled out model HCA templates and guidance plus resources for municipalities and operators. Operators should still review agreements carefully; audits and litigation continue to shape enforcement. See the CCC’s HCA hub.

Delivery licensing (extended exclusivity): The CCC extended the delivery license exclusivity window (Delivery Courier, Delivery Operator, Delivery Endorsement) to at least April 2026 while it studies market performance.

Seed-to-sale tracking & lab compliance: Massachusetts uses Metrc statewide. In 2025, the CCC issued an Administrative Order requiring Independent Testing Laboratories to upload Certificates of Analysis (COAs) to Metrc’s system of record to strengthen transparency.

Social consumption (proposed): The CCC is advancing social consumption via formal rulemaking; draft regulations were released for comment in August 2025. Until finalized, on-site consumption remains limited.

Equity programs & financing: Massachusetts operates a statewide Social Equity Program and a Cannabis Social Equity Trust Fund that issued FY25 grants and received new deposits in 2025 to support eligible entrepreneurs.

Federal context: The SAFER Banking Act (S.2860) remains pending (not law). Banks serving CRBs continue to follow FinCEN’s 2014 BSA/AML guidance. The DEA’s proposed rescheduling to Schedule III is still under review; no final rule has taken effect.

As your cannabis banking partner in Massachusetts, Herring Bank pairs rigorous compliance with industry-specific treasury solutions—secure deposit accounts, online banking, ACH and wires, and a statewide armored-courier network—aligned to CCC rules and federal BSA/AML expectations.

Frequently Asked Questions

Can dispensaries use banks?

Yes. Licensed cannabis businesses in Massachusetts can access banking with institutions that adhere to FinCEN’s cannabis banking guidance and robust BSA/AML controls. Herring Bank provides compliant CRB services.

What types of cannabis companies do you support?

We bank retailers/dispensaries, cultivators, product manufacturers, testing labs, wholesalers, delivery operators/couriers, and licensed transport/security providers, plus select ancillary businesses directly supporting licensees (subject to underwriting and compliance review).

What is the banking act for cannabis?

The SAFER Banking Act is the current federal proposal for safe-harbor protections. It has not been enacted; today’s banking relies on FinCEN’s 2014 guidance and risk-based compliance.

What recent operational changes should MA operators know?

Expect continued CCC implementation of Chapter 180 (HCA oversight, equity measures), the delivery exclusivity extension to April 2026, and COA uploads in Metrc for stronger supply-chain transparency.

What are the benefits of partnering with a specialized financial institution?

Specialized CRB banking reduces cash-handling risk, integrates armored-courier deposits, streamlines ACH/wire payables and receivables, and maintains documentation aligned to CCC guidance and federal AML expectations—supporting smoother exams and audits.

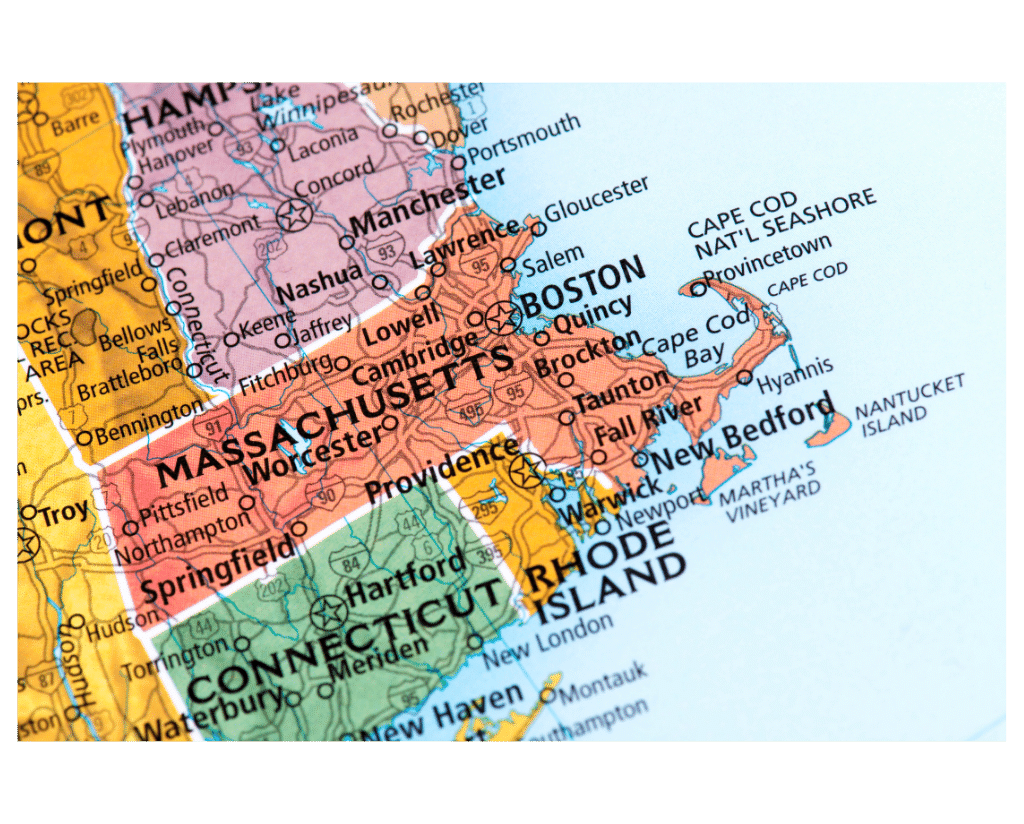

What cities do you serve in Massachusetts?

Herring Bank offers cannabis banking services across the Commonwealth, including Boston, Worcester, Springfield, Cambridge, Lowell, Brockton, New Bedford, Quincy, Lynn, Fall River, Newton, Somerville, Framingham, Waltham, Haverhill, Malden, Brookline, Plymouth, Medford, and Taunton. We also operate a statewide armored-courier network to securely manage cash deposits for cannabis companies.

Ready to discuss how we can help you and your Cannabis Business in Massachusetts?

Colorado Cannabis Banking & Armored Courier Services:

Colorado Springs, Denver, Aurora, Pueblo, Arvada

California Cannabis Banking & Armored Courier Services:

Los Angeles, San Diego, San Jose, San Francisco, Fresno, Sacramento, Long Beach, Oakland, Bakersfield, Anaheim, Santa Ana, Riverside, Stockton, Chula Vista, Irvine, Oakland,

We provide Cannabis Banking Nationwide

Alabama, Alaska, Albany, Albuquerque , Anaconda, Billings, Boston, Bozeman, Buffalo, New York City, Detroit, Flagstaff, Grand Rapids, Gulfport, Jacksonville, Jersey City, Las Cruces, Miami, Montana, Newark, Santa Fe, Oklahoma City, Las Vegas NM, Portland, Silver City, Carlsbad, Philadelphia, Phoenix, Scottsdale, Clovis, Orlando, Tulsa, Ann Arbor, Colorado, New Mexico, Michigan, Illinois, Massachusetts, Minnesota, Missouri, Oregon, Virginia, Washington, Nevada, Kentucky, Vermont, Delaware, Espanola, Farmington, Arizona, Arkansas, Baton Rouge, Connecticut, Maryland, Minneapolis, South Dakota