You’ve been pre-approved. You’ve found a realtor. Your budget is set. You’re ready! Right!?

Here’s what you need to know when you’re actively looking at houses and how to make the right steps to increase your odds of success!

Here’s what you should consider when shopping for a new home

Home buying can easily become a learn-as-you-go adventure.

Make a mistake, though, and either your wallet will be hit, or you’ll miss out on a great home.

So that doesn’t happen, consider these when shopping for a new home.

First things first, do NOT wait to get pre-approved!

If you’re ready to buy a home, don’t wait to get pre-approved for a mortgage.

When you find a house that you want, you’ll be able to make a stronger offer if you’re already pre-approved for a loan.

Why?

Because pre-approval indicates to the seller that you can afford to buy the home. Sellers are much more likely to jump on a home offer from a buyer who already has his or her finances in order.

Start wide and narrow your focus by choosing and eliminating neighborhoods

As you shop for homes, don’t just think about the home itself; also consider the neighborhood.

Is it the place you want your kids to grow up? Take a look at the schools. How are they performing on state tests and the SAT? What’s their dropout rate? All of these are indicative of the type of learning environment your children would be exposed.

Likewise, what type of crimes are in the surrounding area?

Do you want a move-in ready house?

Move-in ready houses cost more up front and will likely add a little bit to your monthly mortgage payment.

A rough estimate would be $50 a month for every $10,000.

The great thing about these types of investments is that there’s likely nothing you need to immediately worry about in regards to home repairs or home updates. Your weekends can be spent at home rather than the hardware store.

However, ‘perfect’ houses are only perfect for so long. No matter what house you buy, you’ll likely spend about 1% of the purchase price on maintenance each year.

Is a fixer upper the better buy?

Fixer upper homes will save you money on your home loan, as they typically cost less to purchase.

But keep in mind that the more money you save by buying a fixer upper home, the more money you’ll likely need to spend on upgrades and repairs up front.

If you decide to pay for the upgrades with a credit card instead of cash, the interest you’ll pay on credit card bills could easily negate any savings you got on the mortgage loan.

Of course, fixer uppers allow you the opportunity to make the house completely your own.

Depending upon the condition of the house when you buy it, a lot of updates and repairs can take place over time. If you decide to sell it, you run a good chance of getting a return on your investment and then some.

Don’t just check the home’s neighborhood, also check the neighborhoods around it as well.

Should you wait for a perfect housing market?

Waiting for a buyer’s market versus a seller’s market is a fool’s game and is nearly impossible to predict (ask any real estate tycoon).

If you’re ready to start house hunting, start shopping now. Don’t wait.

If you find a house you like, put an offer on the table. The cost difference between the two housing markets is rarely different enough to worry about.

When you wait, you just increase the likelihood that you’ll miss out on a great opportunity.

And you’re off!

You can then refer back to your notes to help you choose the best home for your needs and make an offer.

You’ve found it! THE house! Now what?

As a first-time home buyer, you need to consider a lot of things before you make an offer on a home.

You need to move beyond whether the house looks like a great fit and take a hard look at the finer details of the house and whether buying the home fits your long-term goals.

Here are eight things to evaluate before you make an offer on a home.

Increase your odds of getting your offer accepted

Haggling used to be a cornerstone of commerce, but now the art of negotiating price is rarely an option.

A home’s list price is almost always a guideline based on current market value.

Smart negotiation can often get you a good deal that will save you a lot of money, but you have to know where to begin.

Going into a negotiation for a house can be daunting, but following a few simple strategies can help you make sure you get the best value when buying a home.

Have a Good Real Estate Agent in Your Corner

Knowing how hard to push for a good price can be difficult, especially if you’re a first time home buyer.

A seller will be able to tell if you aren’t confident in your offer, and may take advantage of that to command a higher price.

That’s why working with an experienced real estate agent is a good idea if you’re new to the home buying process.

Not only will a real estate agent have the confidence and experience to negotiate on your behalf, but they will also bring valuable knowledge of market trends and property values to the table.

A good real estate agent will also know where you can negotiate costs other than the price of the house. Having the seller contribute more towards closing costs and repairs can help you save money in the end.

Get Your Own Appraisal and Inspection

Don’t trust what the seller or the seller’s agent tells you about a home.

They’re doing their very best to make the house seem more appealing – and more valuable – by using smart language and carefully-selected photographs.

An independent appraisal of the home will give you an unbiased estimate of its value that might be different to what the seller is telling you.

It is a good idea to get your own inspection of the house as well.

This helps you to be sure you know about any defects or necessary repairs, and use that information in your negotiations. Damaged or outdated parts of the home lower its value.

You may be able to persuade a seller to pay for repairs with an attractive offer for the house itself.

Have Your Financial Ducks in a Row

Presenting yourself as an attractive buyer is the best way for you to persuade a seller to be flexible on sale price and contribute to costs.

That doesn’t mean putting on your best clothes for the negotiations. Waiting a long time to close is disadvantageous to the seller, so getting preapproved for a mortgage loan shows that you can finalize the sale quickly.

A big down payment also demonstrates your strength as a buyer by showing commitment and the financial responsibility you will need to make your house payment.

Stay Ahead of the Competition

At times, demand for housing can outstrip supply by quite a bit, which means that there are almost certainly competing offers on the home you want.

In this case, a low offer won’t get you anywhere. Treat the seller with respect and professionalism, and demonstrate why you’d be a good fit for the home you’re buying by describing your family or your lifestyle in a letter.

Older homes often have years of memories attached for their former owners, so make it clear that you’ll treat the home with respect and love.

Most importantly, though, don’t get desperate.

Keep your cool even if negotiations aren’t going the way you want them to. If you look desperate, a seller will try to leverage that for a better offer.

Remember that there are always more homes out there, and that will help you stay calm as you negotiate smartly.

How to make an offer on a house

It passed the test! You’ve found the home of your dreams!

It’s got a state of the art bathroom, backyard patio area for cookouts, and a dining room and kitchen perfect for creating memories with family and friends for many years to come.

Now it’s time to learn how to make an offer that will transform this dream into a reality.

Before making an offer

After finding a house you want to purchase, there are several steps to take before presenting an offer.

Avoid buyer’s remorse by doing the following:

Be doubly assured of your budget

You don’t want to go into negotiations and have your heart on a property that you later realize is out of your price range.

If the loan amount that you’ve been pre-approved for by your bank or lending institution seems too expensive for your budget to bear, it probably is. Be honest with yourself.

Can you afford it?

Estimate the price of the home you can comfortably afford. You can try using our Affordability Calculator

What will your monthly payment be?

Be confident with the monthly payment amount that you are secure about paying for years. Check out our mortgage payment calculator, which can help give you a better idea of what your monthly payments will be.

Do you have the down payment?

It’s rare, if not impossible, to find a lender willing to finance 100% of the cost of a house – meaning, you’ll need to make a down payment.

Calculate the amount of down payment you’ll need. The cost of the house minus the loan amount equals the down payment required.

Be aware that the down payment does not include the loan closing fees or other fees that the terms of your contract might require.

Have you calculated the closing costs?

Closing costs include fees such as lender and title company fees, home owner’s insurance, and escrows for taxes and insurance.

Use our closing cost calculator to get an idea of what your’s might look like.

How much to offer

Making an offer on a house is difficult because if you bid too low, others will outbid you; if you bid too high, you will be throwing money away.

This is where all your research comes in to play, as well as the experience of your real estate agent.

Other than how much you can afford, here are some additional things to keep in mind:

Closing costs

First-time home buyers often fail to take into consideration the costs they will be required to pay at closing when securing a loan.

These can amount to as much as 5% of the price of the house. Closing costs should be a factor to consider when deciding how much to offer for a property.

The seller’s price

The offer you make will depend upon the seller’s listing price of the home.

When determining a price, sellers typically follow one of three paths:

– Some sellers overprice the house to provide them ample room to negotiate.

– Sellers that don’t wish to negotiate often list the house at an amount they think they can easily get.

– Some sellers underprice the house, hoping it will attract many buyers and create a bidding war.

Prices of comparable houses

What have similar homes in the same area sold for recently?

To ensure true comparability, look for houses in the same neighborhood that are similar in terms of age, size, number of rooms, and that have sold within the past six months.

You can also gather information on comparable homes that are currently listed for sale.

The real estate market

The market will help determine the amount you should offer for a house.

During a “sellers market,” houses are in great demand and buyers should expect their offer to be one of several, which may result in bidding wars that will drive up the price of a home.

Conversely, in a “buyer’s market,” you can safely offer less than the house would otherwise be worth.

Is the house uniquely valuable?

If a house has something special about it that makes it uniquely valuable to you, consider offering more than you believe it’s worth to ensure that you are the winning bidder.

“Special traits” might be sentimental or practical, such as mother-in-law quarters, a perfect office, or a location that is close to your work, schools, or local attractions.

The seller’s position

Know the seller’s position when making an offer on a house.

Being flexible and catering to the seller’s needs could help you close the deal.

For instance, a seller may be willing to take a smaller amount if you are able to close quickly and come to the table with a loan pre-approved or with a cash offer.

Adding contingencies to an offer

Most real estate offers contain contingencies — events that must take place within a specified amount of time (such as 30 days) before the deal can be finalized.

For example, you may want to make your offer contingent on your qualifying for financing, the house passing certain physical inspections, or your ability to sell your existing house first.

The seller may also add contingencies to the offer, such as a condition that he or she has found another house to buy before closing the sale with you.

Making the offer

If you have a real estate agent, which is highly recommended for first-time buyers, they will help you write an offer and submit it to the seller or the seller’s agent in writing.

The offer will include:

– The address of the home

– Your name and the names of anyone buying the house with you, such as your spouse.

– The amount of your offer

– Any contingencies you’re requesting (i.e., conditions that must be met before the sale is a completed deal), such as a successful home inspection

– Any seller concessions you’d like (i.e., things you’re requesting from the seller), such as cash toward closing costs.

– Items you want to include in the sale, like appliances and window treatments

– The amount of your earnest money deposit

– Your pre-approval letter, so the seller will know that you won’t run into any financing problems

– The date you expect to close

– The date you want to move into the house

– The deadline to respond to your offer

– A deadline for the inspection to be completed, known as the option period

– A deadline for third party financing to be approved

Negotiating can be stressful, so it’s important to keep your goals in mind. Don’t forget that it’s okay to walk away from the deal if you and the seller can’t agree to terms.

There will always be another house. A house is a long-term purchase, so you should take a long-term view.

Including a buyer’s offer letter

A buyer’s letter is sent to the seller on behalf of the buyer. It is a unique way to make your offer stand out among your competition.

It sounds strange, but in many cases, it needs to be done, and, more importantly, it often works.

If this is the season when you plan on buying a home and you want to get a potential edge over your peers, keep reading.

Buying Sometimes Requires a Connection

A buyer’s letter is like putting your picture on a resume. It makes your offer more personal and elevates it.

If you’re in the market to buy, keep this strategy tucked away in your back pocket. You may need it to get that house you love.

Now, it’s time to put in your offer!

If it’s accepted, celebrate, but not too much.

You’re not done quite yet.

There’s still a little more left to do before you close and the house is yours.

The home inspection – what you need to know

After your offer has been accepted, it’s time for the home inspection. Until you’ve gotten through it, nothing’s final.

Even the most beautiful of homes can have a secret, and it’s the home inspector’s job to find out what it is.

If you have questions about anything involved with home inspections during the home buying or home selling processes, here’s your chance to finally get some answers.

What do home inspectors do?

A home inspector’s job is to determine the condition of a home before it is bought. Home inspectors check the condition of the following when buying a home:

– Foundation

– Plumbing systems

– Windows

– Doors (interior and exterior)

– Walls (interior and exterior)

– Floors and ceilings

– Roof

– Electrical systems

– Heating and cooling systems

– Basements, attics and attic insulation

– Functionality of built-in appliances

Who pays for home inspections?

Typically, the seller pays for the home inspection; however, it is possible to get the seller to pay for it when buying a home if it’s negotiated in the home offer.

How much do home inspections cost?

Home inspections usually cost between $200 to $400. Factors affecting the price include the size of the house and the purchase area. Most people pay around $315.

Why are home inspections important?

Home inspectors alert home buyers if there is anything wrong with the home that might interfere with them living in it. Some problems can affect your health, while others your wallet. If either is the case, it may interfere with your ability to pay upon your mortgage.

What can’t home inspectors do?

Home inspectors can’t tell you how much a repair would cost (even if you ask them to give you just a ballpark figure).

This is because they’re legally not allowed to speculate and they’re not licensed contractors.

They will instead recommend further inspection by a professional for issues such as plumbing, roofing, and electrical.

Lastly, home inspectors can’t advise you not to purchase a home. They can only give you the facts about the condition of the home. It’s up to you how to interpret those facts.

Are home inspections mandatory?

No, many people often buy homes without getting a home inspection.

People often do this to make their offers more appealing or to save money. They assume that any issues the home has are typical, or they assume the opposite and that it needs a lot of work. Why spend more money than they have to?

The problem with this is that if you’re not a licensed contractor, or you don’t already plan on gutting the house, you simply don’t know what you don’t know.

If lenders don’t require home inspections, what do they require?

Lenders require an appraisal before they can approve a mortgage because the condition of a home also comes up during a home appraisal. If the home does not appraise for more than the purchase price, the loan will not be approved.

And finally, before you get the keys, you have Closing Day – the dreaded closing costs

When it comes to buying a home, the selling price, monthly mortgage payments, and down payment are not the only costs involved.

To make sure you understand everything you need to know about closing costs, take a look at our guide below.

What are closing costs?

Closing costs are fees associated with your home purchase that are paid at closing – when the title of the property is transferred from the seller to the buyer.

Both buyers and sellers pay closing costs to the service providers who help facilitate the transaction.

Although a number of factors influence how much you can expect to pay, closing costs often range between 2% and 5% of the total purchase price. The fees included in your closing costs will mostly depend upon the price of the home and the type of loan you choose.

Closing costs include your down payment on the home as well as recurring fees, such as property taxes and insurance premiums, and non-recurring costs such as title company fees, application fees, home inspection costs, credit report costs, and property appraisal fees.

How can you know what to expect?

Knowing that you will have to pay an uncertain amount in addition to the cost of your home may seem intimidating, but you will not have to go into the purchase completely unprepared.

Legally, your lender is required to provide certain information to help you through this process.

Once your loan application is submitted, your lender will provide a loan estimate, which will estimate your interest rate, monthly payment, and closing costs. At least three days before you close on the loan, your lender will provide a closing disclosure, which lays out the terms of your loan, your projected monthly payments, and the closing costs of your loan.

Can you avoid closing costs?

Closing costs are an expensive additional cost to consider when buying a home, and it is impossible to avoid them altogether.

However, there are some ways to reduce your cost burden. Spend some time looking through the service breakdown on your loan estimate and ask your lender about the possibility of shopping around for certain services.

You can also negotiate the portion of the closing costs that the seller is responsible for. If you don’t have the money to pay closing costs upfront, it is also possible to include the closing costs into your mortgage loan. Although you will end up paying more in the long run, this is a good option for those who want to break up the payment of the closing costs.

And you’ve made it! The house is yours!

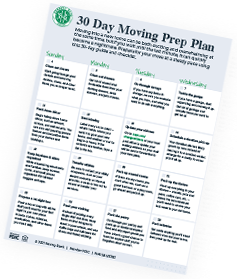

Moving into a new home can be both exciting and overwhelming at the same time.

If you wait until the last minute, it can be a down-right nightmare. A little bit of preparation can save a TON of time! Get ready for your move with our list of tips and tricks to help you save time.

You are here

From shopping for a new house to closing

The Herring Bank Mortgage Team went above and beyond to ensure a seamless buying experience. I knew my loan would be a difficult one to get done and they made it seem easy.