Take the quiz to see how you might consider investing based on your risk tolerance level.

Find your risk tolerance level

No one is the same when it comes to investing, but almost all investors fall into one of five categories.

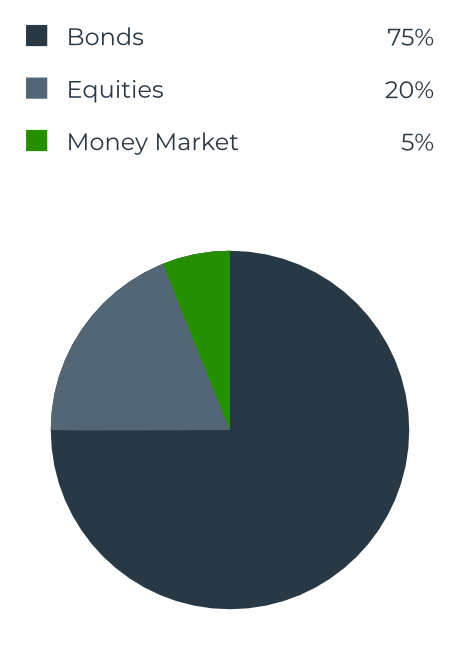

An income first, growth secondary portfolio

Might be right for you if:

You’re most comfortable knowing that your money is protected from extreme market fluctuations, but you need some equity in your account to keep up with inflation.

You want to increase your savings but provide some protection for what you have.

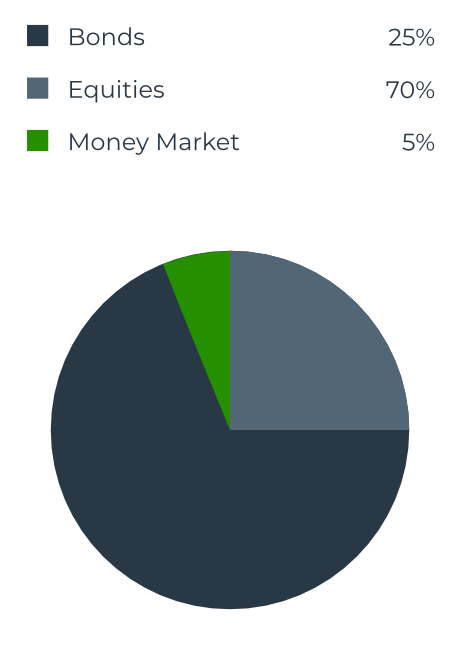

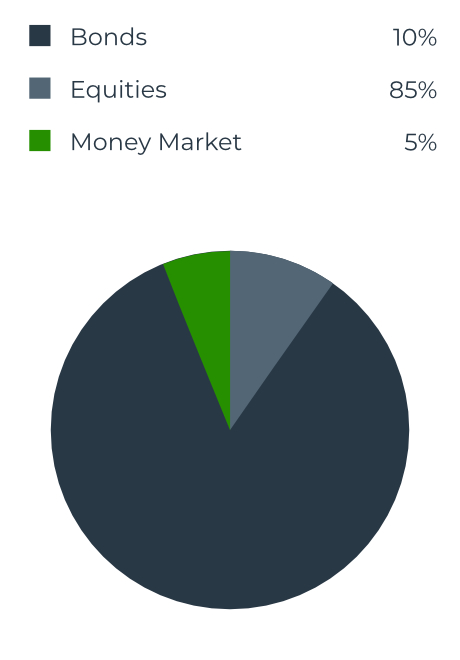

A growth portfolio

Might be right for you if:

Your aim is to make your money grow. You know that investing over the long-term can help you reach your goals.

You understand there are short-term risks, but over the long-term you feel confident that equities offer the highest potential for growth.

An aggressive growth portfolio

Might be right for you if:

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED