Equities Retreat to New Lows Amid Rising Bond Yields

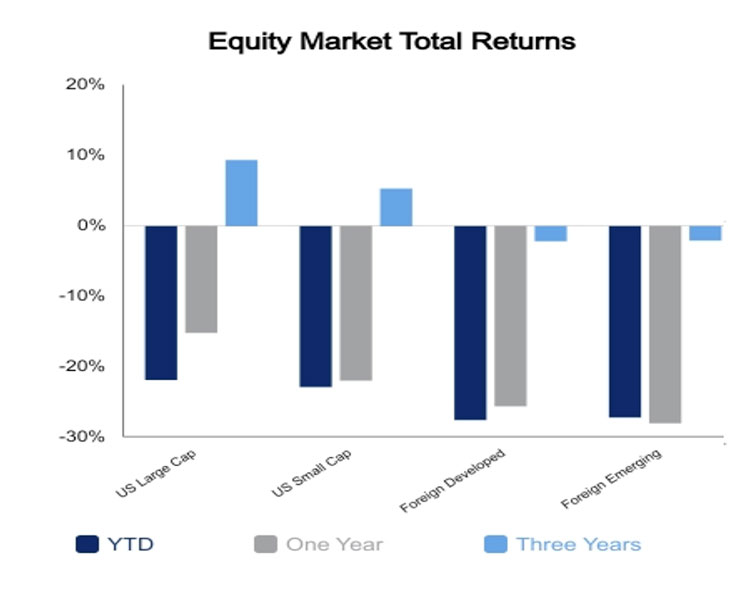

Equities traded lower this week with the S&P 500 trading at its lowest level of the year. The index finished down 1.9% on the week and is down 21.1% on the year.

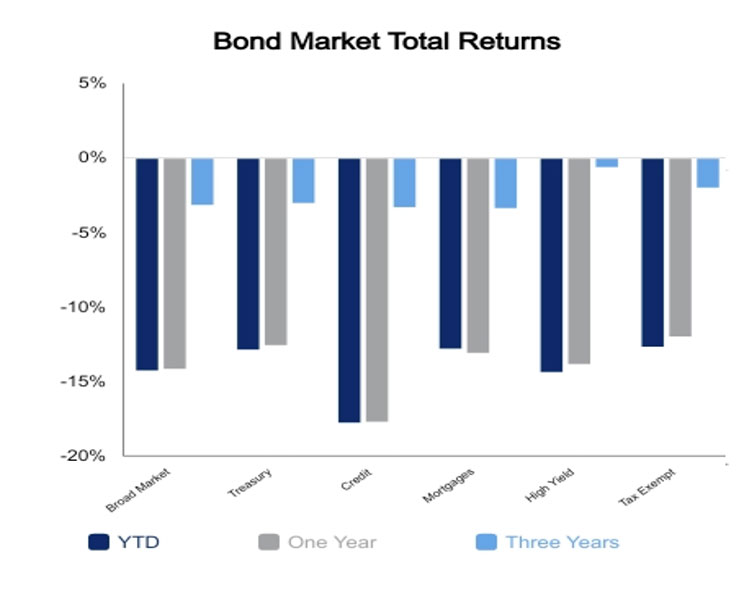

Emerging markets were down 6% on the week as global currency and bond market volatility spiked. Domestic yields were up and led to a 1.6% decline in core fixed income indices. September has been a difficult month for returns as the S&P 500 is off 5.9% and core fixed income is down 3.8%.

Often weak September equity returns set the stage for a rally as quarter‐end rebalancing creates some needed flows. However, fixed income under performed equities this quarter, thereby potentially adding to recent market weakness.

Global Markets in the Spotlight

It was a crazy week in currency and fixed income markets following a surprise budget announcement from the United Kingdom.

In short, they announced tax cuts amid surging inflation. The market essentially treated them like an emerging market country. Their bond yields surged, and their currency collapsed.

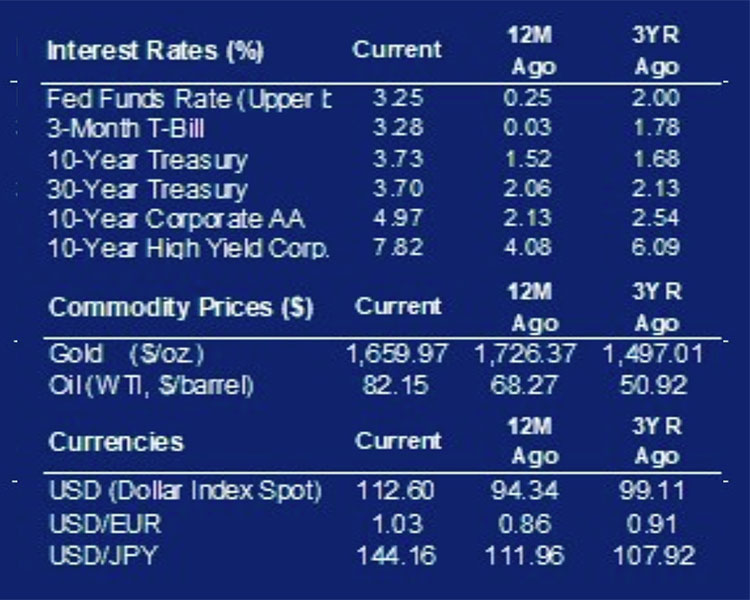

The currency would drop 8% in less than two days and hit an all‐time low versus the U.S. dollar. The UK 2‐year government bond yields jumped 120 basis points in three days while their 30‐year government bond yields jumped 130 basis points. This caused long government bond prices to be down 50‐60% from issue price.

On Wednesday the Bank of England intervened in the bond market and committed to buy unlimited amounts of long bonds to stabilize the market. It would later be revealed that large pension funds made the call to the central bank as they would be imminently insolvent unless something was done.

Amid market turmoil, the central bank started a form of yield curve control under the guise of ensuring stable markets. The market is still pricing significant hikes from the Bank of England to help stem anticipated inflation. U.S. bond markets moved directionally with UK yields and the 10‐year Treasury pierced 4.0% this week.

Will Earnings Season be the Savior?

Earnings season will likely take the spotlight away from the macro and central banks in coming weeks. There is a wide divergence among analysts on what the outcome will be, especially regarding forward guidance. Some have viewed weakness as already priced in, but some recent stock reactions would suggest otherwise:

- FedEx missed earnings by a significant amount, although this was viewed as company specific.

- This week Apple announced plans to cut production increases with lower iPhone 14 sales than anticipated versus the high end of expectations.

- CarMax missed earnings with the stock plunging. This is being taken as broad weakness from consumers regarding used autos.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED