Equities Shrug Off Bad News as Rally Approaches 10% from October Low

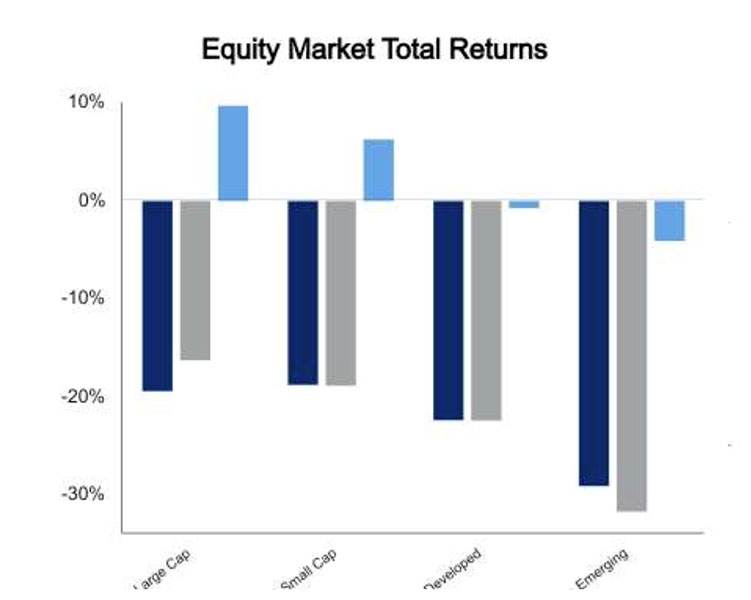

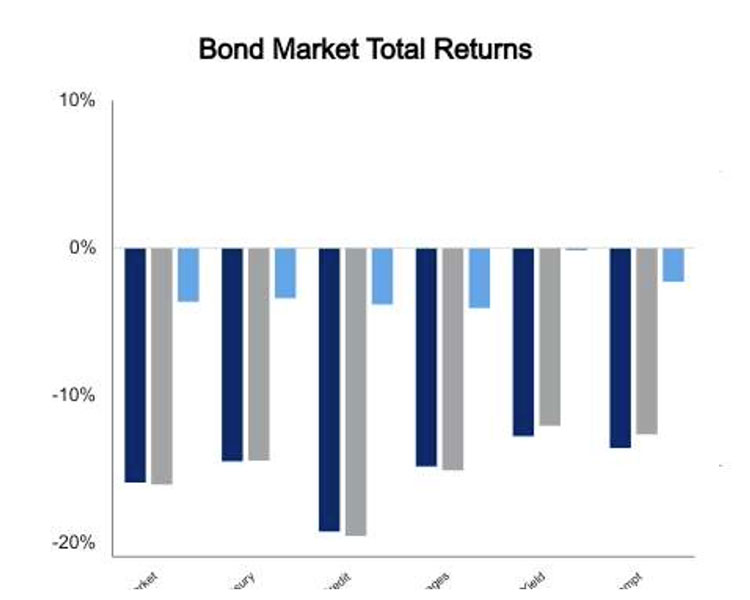

The equity rally continued this week despite bearish headlines. Large cap technology names were very weak and yet the S&P 500 was up 3.7%. Real strength was seen in small caps, which rallied 4.6%, while oil field service stocks jumped 12.2%. Oil-related equities have begun to outpace the market again. Core fixed income was up 0.8% on the week as yields pulled back from highs.

Key Economic Data on the Week

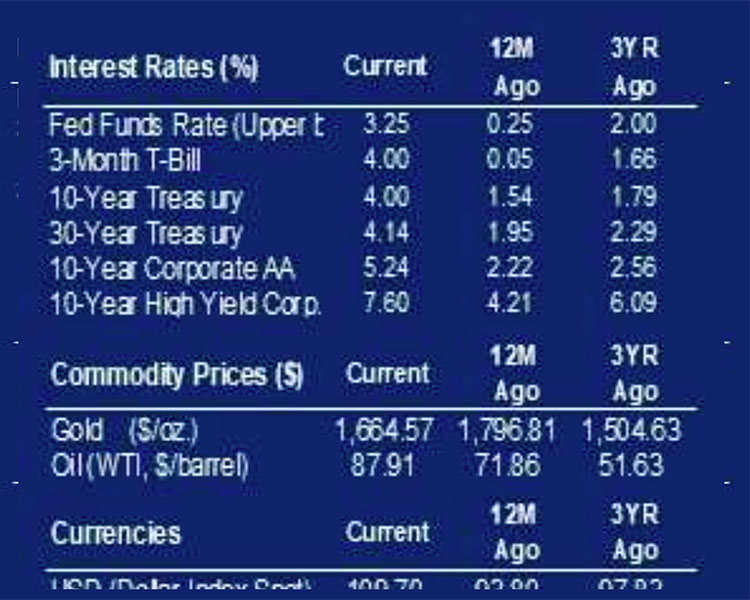

- The 10-year Treasury hit 4.33% on Friday, but now sits almost 40 bps lower.

- The S&P Global Services PMI had a huge miss at 46.6 versus expectations of 49.5.

- Markets rallied of course as the mindset is bad news brings us closer to a Fed pivot.

- The CoreLogic 20-city House Price Index is down 3.7% over the last six months, more than three times larger than any time back to series inception in 2000.

Wild Week for Equities

This was one of the crazier weeks in the equity market in recent memory. The bearish headlines started over the weekend when China unveiled their new leaders. Xi Jinping made a public dismissal of a very high-ranking rival and stacked the committee with his allies. Geopoliticians were in consensus on the importance of this move as it solidified his power without many checks and balances. The China Golden Dragon Index, which is U.S. listed companies focused on China, fell 14% for the largest single-day drop ever. Normally, this would spill over into the U.S. markets for a sizeable pullback, but instead the S&P 500 was up more than 1% on Monday.

Alphabet, parent company of Google, was down more than 9% on Wednesday after reporting earnings. It was the second largest one-day drop in the company’s history. Alphabet is the third-largest company in the S&P 500. Microsoft reported at the same time and its stock was down more than 7% on the day. Microsoft is the second- largest domestic stock by market capitalization. Small caps and the Dow Jones Industrial Average were up on the day, which is remarkable.

Every Mega-cap technology-related company to report this earnings season has seen a huge drop in their stock price the following day. All eyes are glued to Apple and Amazon, which report tonight. Certainly, the market can’t rally if the top five stocks in the index all drop by a sizeable amount post-earnings. But the upside in both could propel equities into the Fed meeting next week, where expectations are high for some acknowledgement the hiking cycle is nearing an end.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED