Equities stage huge reversal off the lows, but will it hold?

Volatility remains elevated as equity indices posted three consecutive 2% change days. The action started last week with a hotter than expected Consumer Price Index (CPI) report that led the S&P 500 to drop more than 2% to start trading on Thursday.

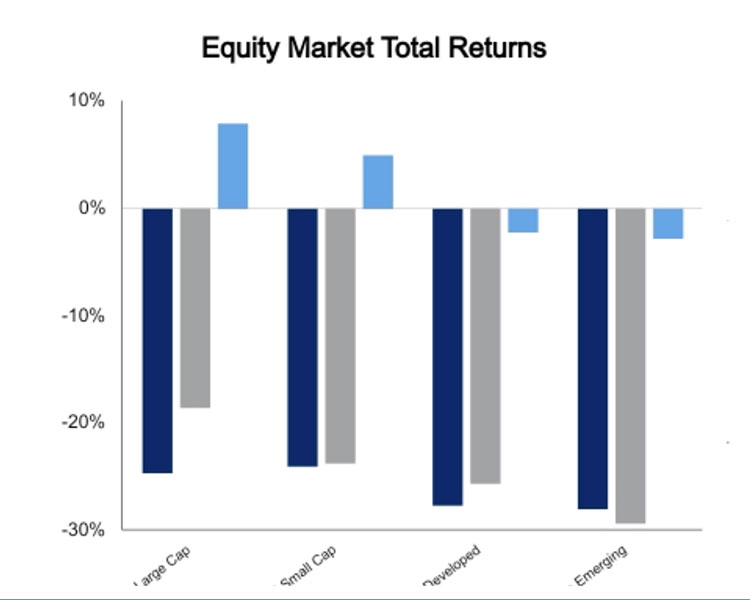

It would finish the day up more than 2%. The index would then lose more than 2% on Friday only to gain 2.5% on Monday. For the week the S&P 500 finished up 3.3% with the energy sector coming to life and posting a gain of 5.2%.

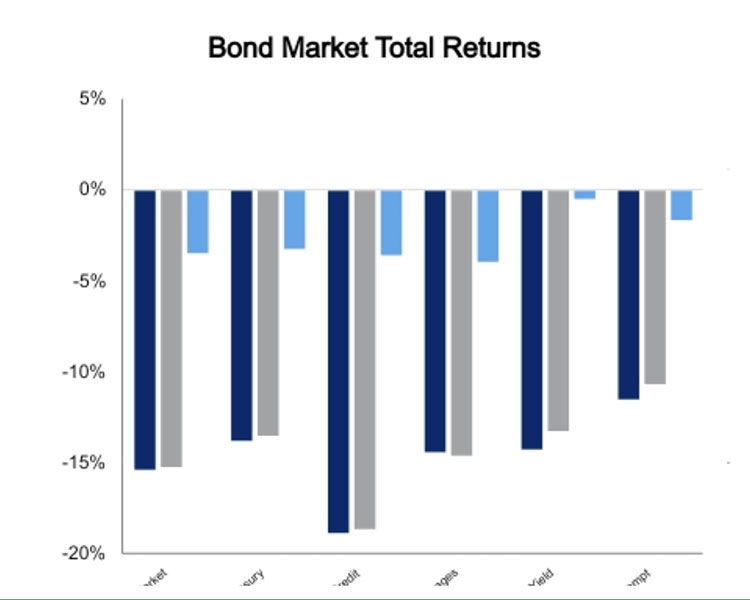

Emerging markets and foreign developed equities were positive on the week but lagged domestic indices. Core fixed income was down 1.4% as yields moved higher.

CPI confuses the crowd

The CPI came in a bit hotter than expected at 8.2% versus the prior year. The knee-jerk reaction was for yields to spike and equities to drop. By the end of the day, yields would be well off the highs and equities would be more than 5% off the lows.

It wasn’t too hard to see this coming as there was extreme bearishness heading into the event and certainty that a hot report would lead to a sell-off created yet another pain point for crowded positioning.

These were the other noteworthy economic reports over the last week:

- September Retail Sales came in slightly better than expected.

- The University of Michigan 1-year inflation expectation came in well above expectations at 5.1% and likely was the main cause of equity weakness on the day.

- The NAHB Housing Market Index continues its free fall. The 9-month drop is by far the largest in series history back to 1985.

- Jobless claims remain solid and support the notion that we are not currently in a recession.

Can equities decouple from yields?

10-year Treasury yields jumped 18 basis points on the release of the CPI report but ended the day up only 5 basis points. As noted above, this catalyzed the equity rally. However, the yield moved 17 basis points higher over the next four days to trade at new highs on the year.

Equities have thus far ignored this factor and remain about 6% above their low. It remains too early to tell if equities are poised to decouple from higher bond yields.

All tenors of fixed income beyond six months have yields above 4%. The market is now pricing in a 5% terminal Federal Funds Rate to be achieved in March of next year.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED