The Fed Fails to Pivot, Sparking Reversal in Equities

The S&P 500 ended the week down 1.8% thanks to a 3.6% drop in the last 90 minutes of trading as Federal Open Market Committee (FOMC) Chair Jerome Powell extinguished hopes of a bullish Fed pivot.

It was the largest percentage drop for the S&P 500 in the last 90 minutes of a FOMC press conference since they began in 1994.

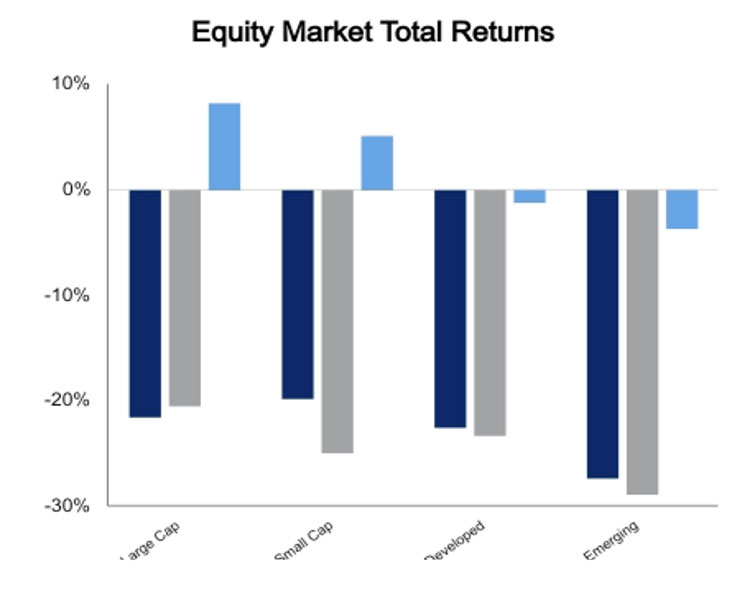

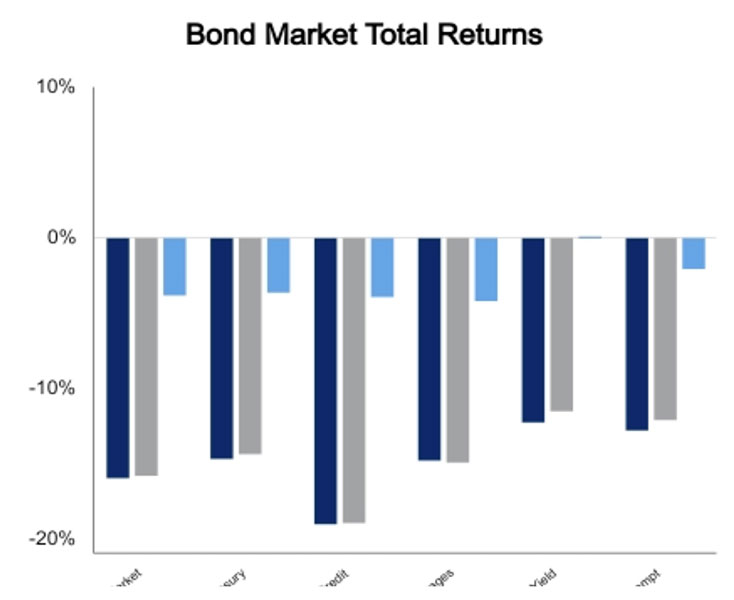

The NASDAQ was hit the hardest this week with a drop of 4.1% while small caps had a milder retreat. Fixed income returns were roughly flat.

Powell Asserts Hawkish View

The equity rally started with credible leaks the Federal Reserve was ready to reduce the pace of rate hikes. With the S&P 500 up more than 11% from its intra‐day low, the Fed was likely going to have to deliver to keep things going.

Not only did the Fed fail reduce the pace of rate hikes, they did so in a rather dramatic way. During FOMC meeting days, there is a press release and then a 30‐minute delay prior to the press conference.

The statement noted that the FOMC was raising interest rates by the anticipated 75 basis points, taking the Federal Funds Rate to 4%. The statement added a new sentence that the Fed would consider cumulative tightening and noted the lag effects of policy.

This statement coincides with the idea of reducing the pace of rate increases. The market rallied 1% immediately following the statement.

Then Chair Powell came to the podium and could not have been more hawkish.

- He noted it was very premature to consider pausing rate hikes.

- There was no dot plot this meeting, but he specifically said if there was then the terminal rate would have moved higher.

- This is very unusual for him to comment on what his colleagues would do as he usually downplays the dot plot.

- He also made it clear he intends to err on overtightening because he believes the Fed has the tools to clean up over‐tightening, whereas they don’t if inflation runs away.

- He noted that he felt the lag of monetary policy had been reduced in recent cycles.

- While debatable, it means the Fed will keep hiking as they believe their previous hikes are already in the data.

- Powell left open the possibility of a 75‐basis point increase at the December meeting, but the market is saying 50 basis points is more likely.

Large Cap Tech Under Pressure

We noted last week that Amazon and Apple earnings were going to be instrumental for equities to continue their uptrend. Amazon is down 19% in just over four days. Despite weak earnings, Apple surged 7.5% last Friday, and held indices together.

It has fallen 10% this week and trades lower than prior to earnings. Large cap technology names remain under pressure.

Next week brings the election which has garnered little market attention, thereby leaving open the possibility of continued volatility.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED