Fixed Income Markets Join Equities in Moving Higher

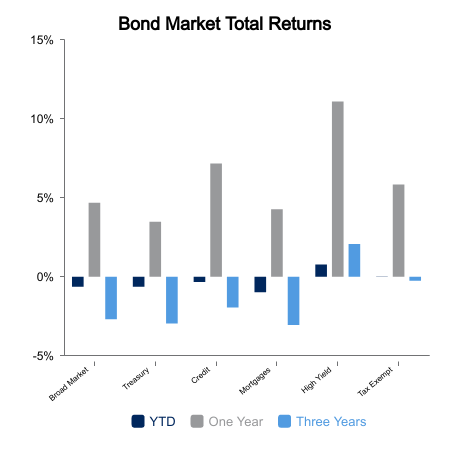

The equity markets continued their strong move higher year-to-date with another week of positive returns. This week fixed income joined in with its own positive return. Specifically, broad bond market indices advanced 1.1% for the week as interest rates moved lower.

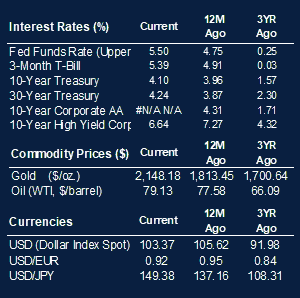

The decline in bond yields is evidenced by the move in the 10-year Treasury from a yield of 4.27% to 4.10% over the one-week period. Inflation data that was in line with expectations contributed to the decline in yields, resulting in a positive return.

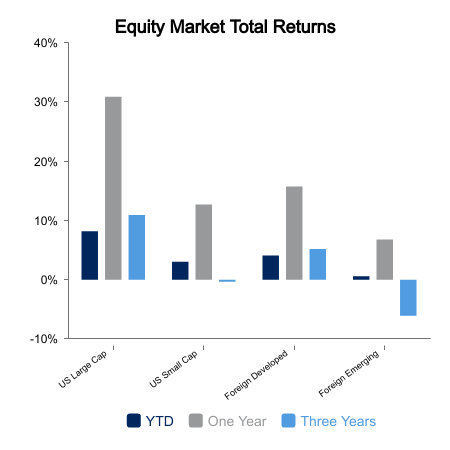

Returning to equities, the broad domestic market, as measured by the Russell 1000 Index, saw a return of 0.6% for the period. Underlying this ongoing strength for equities overall was some greater strength from various underlying market segments.

Value stocks strongly outperformed growth stocks for the week with the Russell 1000 Value Index returning 1.5% versus -0.2% for the Russell 1000 Growth Index. Even more impressive was the showing from lower capitalization tiers such as the Russell Midcap Index which returned 1.6%.

The Russell 2000 Index of smaller companies, while not outperforming the large cap segment, generated a tie with a return of 0.6%.

In terms of economic data, the Institute for Supply Management (ISM) results for the month of February continued to be split between the manufacturing and service sectors of the economy.

While both measures delivered lower than forecasted readings for the month of February, the result for the services sector continued to point toward economic growth with a reading of 52.6.

On the other end of the spectrum the manufacturing sector with its measure of 47.8, continues to be in a contraction phase as it has continued to deliver readings below the level of 50 that delineates growth versus contraction.

Employment Data Somewhat Mixed

On the employment front, the JOLTS job openings report for the month of January registered 8.9 million. This figure was virtually equal to the forecasted level and to the prior month’s release.

This suggests ongoing firmness in the labor market and is supported by the consistently moderate level of initial claims for unemployment benefits. One piece of data that is showing some prospective moderation on the employment front is the quits rate.

The quits rate is viewed as a measure of confidence regarding the labor market on the part of employees. It represents the number of individuals voluntarily leaving their jobs as a percentage of total employment. For the month of January this measure fell to a level of 2.1%, the lowest reading since August 2020.

This suggested that employees are becoming a little less confident in their ability to leave their current position and easily migrate to an alternative.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED