Bank Term Lending Program

Investor focus this week has been on actions taken by regulatory authorities to assure safety of deposits at U.S. banks. On Sunday, regulators put into place a new Bank Term Lending Program that provides an additional safety net under all U.S. banks.

The new borrowing program increased a bank’s borrowing capacity with the Federal Reserve in case a bank experiences liquidity needs because of depositor withdrawals.

Under this program those banks that were closed last week opened again allowing depositors to withdraw funds regardless of amount. A ripple effect regarding the banking system has also been seen overseas as European authorities took actions to pair a stronger balance sheet bank with a weaker one to assure liquidity is in place to address depositor concerns.

Financial Sector Update

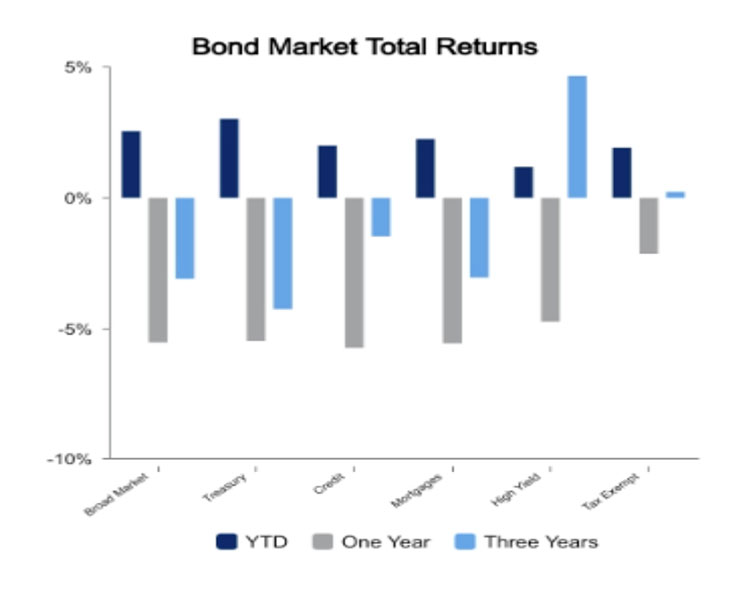

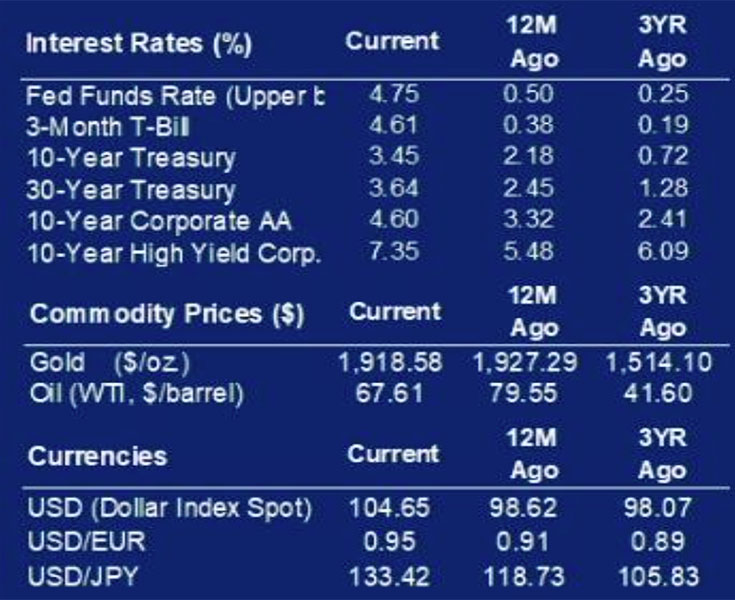

Concerns about banks resulted in a predictable reaction with a “flight to quality” into U.S. treasury bonds. Demand drove treasury yields lower and prices higher with the 10-year U.S.

Treasury bond falling from a yield of 3.9% to 3.4%. Other parts of the bond market were less impacted, but overall, a broad sector measure of U.S. bond markets was up 2.2% for the week, lifting the year-to-date return to 2.6%. Risk off selling pressure for stocks was concentrated in the financial sector.

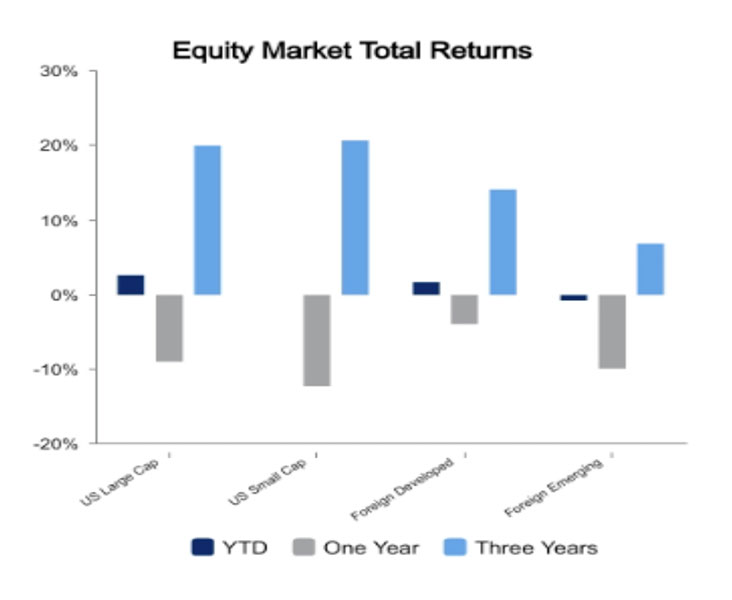

Stock returns measured by the Russell 3000 Index of U.S. equities fell 1.2% this week, while the financial stocks component of this index saw a drop of 6.6%.

Federal Funds Rate

These market movements have sent the Federal Open Market Committee a signal that their next move of the overnight borrowing rate for banks (Fed Funds) should not be a 25-basis point increase, that just last week seemed to be locked in. Markets now believe the 25-basis point move upward will be delayed to the May meeting.

Bureau of Labor Statistics Figure

This week’s Bureau of Labor Statistics inflation figures reported consumer prices up 6.0% for the headline and 5.5% for core – down from 6.4% and 5.6% in January, respectively.

February inflation figures showed a resiliency of core services inflation, driven by housing rents, that supports the idea that the tight labor market is maintaining upward inflationary pressure. Retail sales fell 0.4% in February after climbing in the previous month.

Excluding gasoline and autos, retail sales were flat. Eight of 13 retail sectors saw their sales fall last month, led by furniture and department stores.

Employment Figures

Employment figures released showed payrolls grew 311,000 and the labor-force participation rate rose to 62.5%. Also, average hourly earnings climbed 0.2% from a month earlier.

There was also an increase of new entrants to the labor force that were unable to find jobs quickly, which resulted in the unemployment rate climbing to 3.6%, vs. 3.4% prior.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED