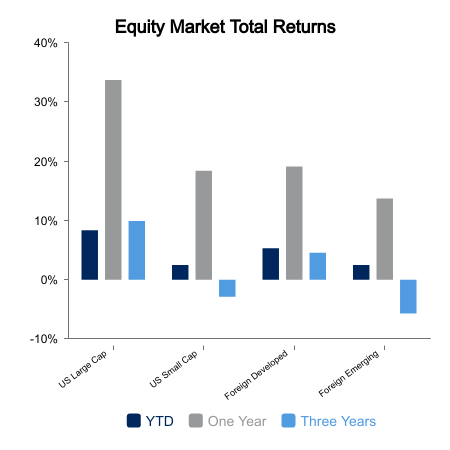

Equity Markets Continue to Rise

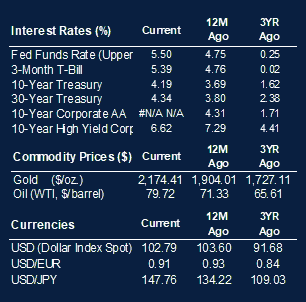

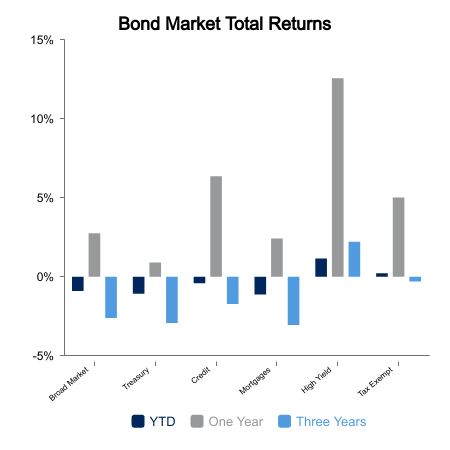

Another week and another new record high was reached in the stock market, although equities sold off slightly after touching the new record level. The S&P 500 finished up 1.2%, while the NASDAQ rose 0.9%. The Magnificent 7 outperformed the broader markets during the week. Small caps underperformed large caps, falling 0.2%. Treasury yields rose slightly, with bond indices down 0.2% during the week.

Inflation Remains Persistent

Inflation, as measured by the Consumer Price Index (CPI) came in essentially in line with expectations for February (3.2% versus forecasts of 3.1%) and a tick higher than last month’s CPI reading of 3.1%.

Inflation continues to be sticky and is above the stated Federal Reserve’s inflation target of 2%. Gasoline and shelter costs contributed most to February’s inflation rate, as well as persistently high motor vehicle insurance and auto repair.

Employment Picture Remains Strong

February’s job figures (nonfarm payroll) came in at 275,000, which was higher than forecasted. This was primarily led by the health care sector. However, the unemployment rate ticked up to 3.9%. This is up from the prior month’s 3.7%. Additionally, the two prior month’s nonfarm payroll numbers for December and January were revised down from their original released figures.

The weekly JOLTS job number, which measures job openings across the country, came in at 8.9 million. This number was higher than expected. The figure is still well above the 10-year average, however down from its peak of 12 million job openings reached in March 2022.

Despite persistently high inflation and a relatively higher interest rate environment, household net worth continues to increase. Total net worth reached a record high $147 trillion, as measured by the Board of Governors of the Federal Reserve System. Rising property values, as well as a recent bull market in equities has propelled household wealth upward since 2020. This was also aided by stimulus funds from the government.

Broad-Based Market Rally

Certainly, there has been much discussion regarding breadth (or lack of it) in the recent equity rally. The United States market overall has rallied versus other international equity markets. It now makes up over 50% of global equity capitalization, something which has not occurred in 20 years.

The S&P 500 is up approximately 8% year-to-date, with the Magnificent 7 group of stocks contributing just over half of the return. The mega cap stocks have become even more “mega-cap-y” with the top 10 stocks now representing 30% of the weight in the S&P 500, something which has not occurred since 1980.

However, the recent equity rally has not been limited to a small handful of stocks. Approximately 75% of stocks in the S&P 500 are currently trading above their 200-day moving average.

This number was under 30% during the latter part of 2023 as only a small handful of stocks were exhibiting significant positive performance during that time.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED