Bond Market now Favors a 50 Basis Point Hike after Powell Opens the Door

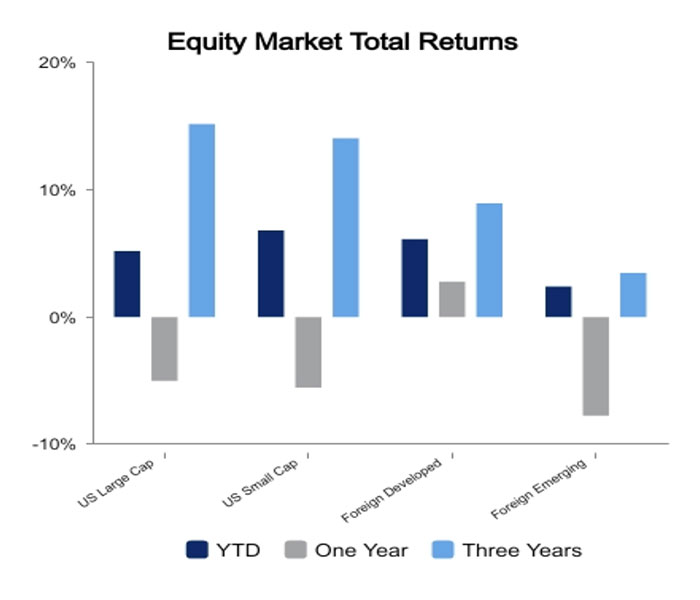

The S&P 500 was volatile on the week but managed to gain 1.1% amid a fair amount of dispersion under the surface. The NASDAQ was up 1.8% while small caps were down 1%.

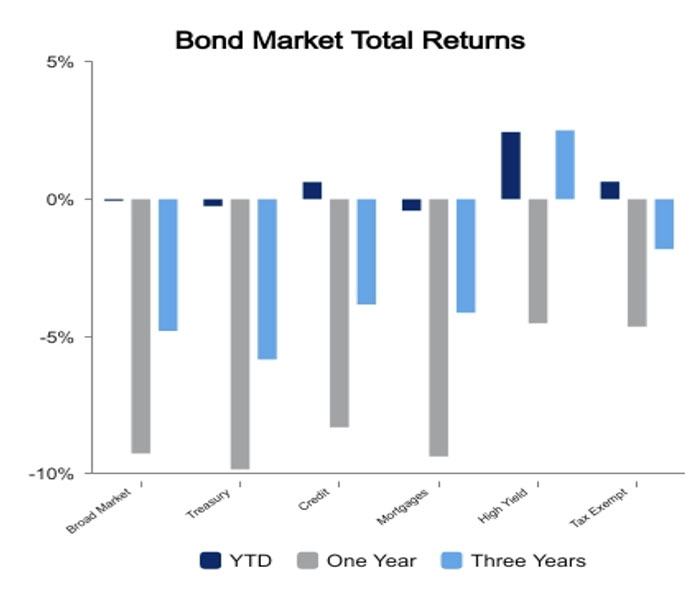

Small caps have been weak of late following strong performance to begin the year. Foreign developed has also lost relative strength in recent weeks. Core fixed income was unchanged.

Commodities Soften

China set its 2023 GDP target around 5%, which is the lowest in decades and weaker than expected.

- Oil and copper remain rangebound but well off 52-week highs.

- The ratio of silver to gold, often a proxy for liquidity and growth, has been in free fall this year.

- Raw industrial prices made a sharp decline in February.

- Commodities are implying a more subdued growth outlook versus the GDP NOW estimate of 2.6% growth for the first quarter.

Powell Opens the Door to 50

Fed Chair Jerome Powell gave Congressional testimony this week. Not unexpectedly, he was very hawkish when being questioned by members of Congress. He did note that he was prepared to increase the pace of hikes if necessary. Stocks immediately retreated on these comments and bond yields moved higher. The 2-year Treasury ended the week up 20 basis points and cleared 5.0% as the market now prices about a 70% chance of a 50-basis point hike in two weeks. The yield curve inversions have pushed to even further extremes this year with the 2-year vs. 10- year now at -108 basis points. This is the largest inversion in over 40 years.

The Fed continues to emphasize their data dependency, which means they don’t have a plan to look through potential noisy data prints to observe a trend. Daily options used by institutions have surged this year as every key economic data print now has a direct feed into Fed policy which in turn has a high correlation to daily asset price moves.

Tomorrow’s jobs number is likely to have a large impact on markets. A high number of job gains opens the Fed to 50 in their next meeting and likely sees stock prices fall. Whereas a more modest print can unwind the 50 basis points and potentially see a huge stock rally. The actual outcome is likely to be somewhat muted as next week quickly brings the Consumer Price Index reading, which was hotter than expected last month. We will also get retail sales and a European Central Bank rate decision as potential market moving events.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED