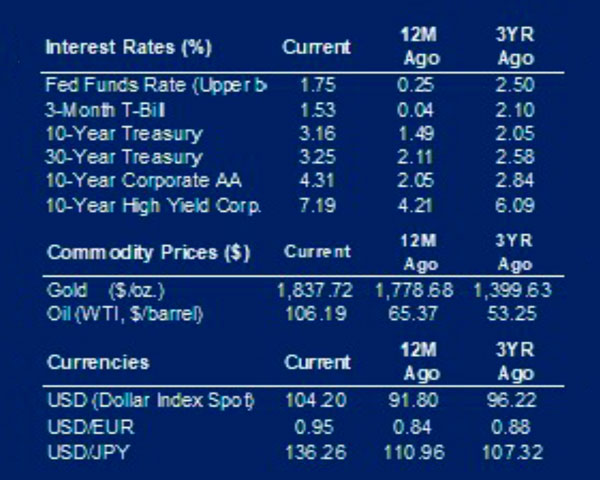

Oil prices dipped over the week

We saw a little bit of a reprieve in gas prices this week. The 8% dip in the price of a barrel of WTI Crude Oil from $106.04 a week ago to $98.15 has not been fully reflected in the prices we pay at the pump. The average price of gas at the pump is $4.94. This is down from a little over $5.00 a week ago.

Part of the drop in price has been attributed to recession fears. The thought is that a recession will reduce demand for the commodity. Government conversations continue around temporarily suspending the gas tax to ease pressure on consumers.

May Housing

Housing was weak in May. Existing home sales fell by 3.4% from April. This is the fourth consecutive month of decreases. The decrease brings home sales to 2019 levels according to the National Association of Realtors. Another insight from the report is an evening of demand between single family homes and condominiums. Throughout the pandemic, there was a preference for single-family homes. Despite the drop in existing home sales, the median price increased. The $407,600 price for the month is the highest median home price ever and the first time this metric has crossed $400,000.

Housing starts dropped 14.4% from April to May. The slowdown in starts is indicative of supply and demand constraints. On the supply side, materials are still expensive. On the demand side, increasing mortgage rates have priced out many from home ownership. On the other hand, house completions were up 9.1%.

The number of building permits issued was lower in May. The 1.695 million permits issued compares unfavorably with the previous month’s 1.823 million and the expected 1.8 million.

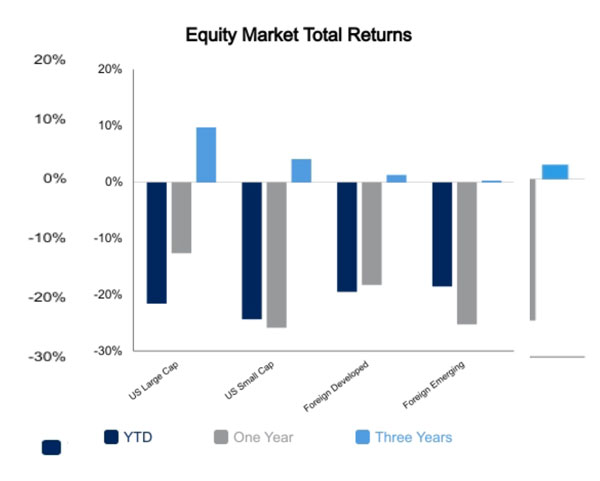

Equity Markets This Week

Equity markets are up 2.5% this week. This increase comes after a single day drop of 3.25% on June 16. The volatility comes as recession probabilities increase. Publicly traded companies continue to adjust their earnings and sales guidance for the year downwards. Part of the earnings expectations adjustments come as companies try to deal with margin compression from increasing costs.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED