First Quarter GDP report sees drop in PCE

This week brought a final recording of the first quarter’s GDP, sealing that number at -1.6%, the first negative quarter since 2020 and a sharp contrast to the expansionary monetary policy primed 5.7% of 2021.

The real shocker in the GDP report was a drop in the personal consumption expenditures (PCE) measure which fell to 1.8% from an earlier reading of 3.1%. PCE accounts for 70% of GDP so this drop showed that consumer spending and the accompanying inflation story are slowing.

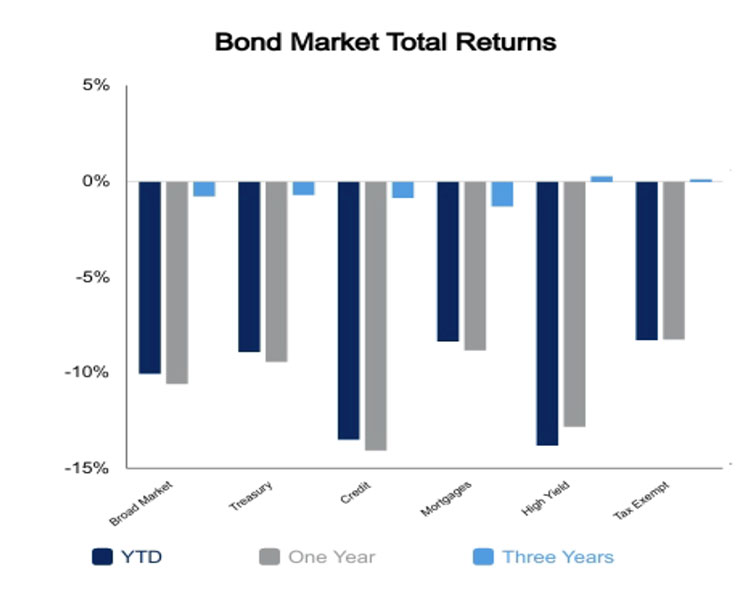

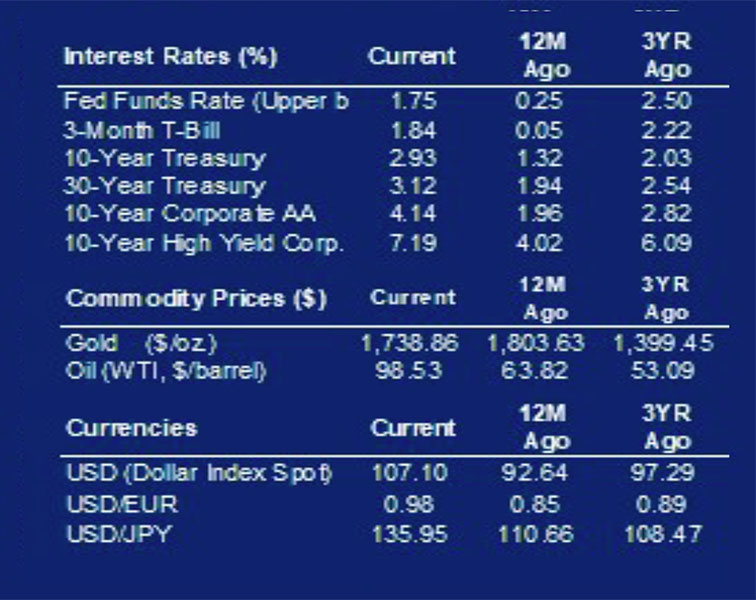

This shift in consumption and other signs of a weaker economic outlook moved bond markets up 2.4% since mid-June and left the yield on 10-year U.S.

Treasuries down from a cycle high of 3.5% at 2.9%. The cost of credit declined this week as the holiday week brought fewer issues to market and positive returns on equities reflected an improved outlook for earnings that support debt payments.

Economy sustaining or slowing growth?

While the consensus forecast shows an economy sustaining growth, recent estimates have pushed the probability of recession to 33% based upon the latest Bloomberg survey.

While not sounding high on a historical basis this is a high level for this measure. Confirming figures of this slowing growth came in from ISM figures as both services (55.3) and manufacturing (53.0) grew, but below the rate of prior months. These ISM figures brought a mix of news.

While the service sector showed widespread growth, elevated recession chatter caused manufacturing hiring managers to become cautious as the ISM employment data showed a contraction to 47.4 from 50.2. Also reported was the Atlanta Fed GDPNow measure that estimates second quarter GDP declined 1.87%.

This contrasts with an economist consensus forecast of 3% for second quarter GDP.

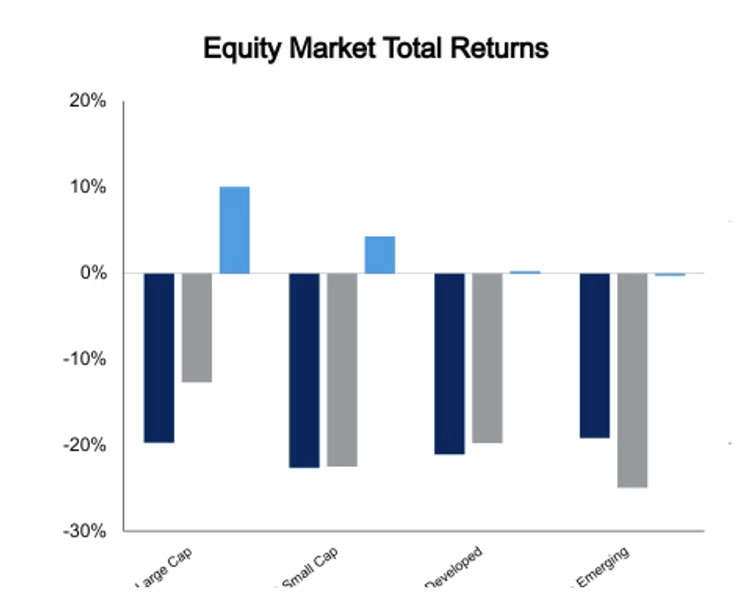

Global Equity Markets

During the shortened trading week global equity markets declined 0.8% as measured by the MSCI ACWI Index. As measured by the MSCI USA Index, local markets did better up 0.74%.

This was despite the oil and gas sector falling on reports of rising oil inventories and pump prices continuing to decline to a national average of $4.75/gallon from a mid-June high of $5.01/gallon.

Overseas equity markets declined 3.2% weighed down by the declining value of local currencies relative to US dollars.

Housing market update

This week’s report showed home prices rose 21.2% year-over-year driven by demand in warm weather markets, but rising inventories and 30- year mortgages at 5.3% slowed the monthly rate of increase from last month.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED