So Close, But No 5,000

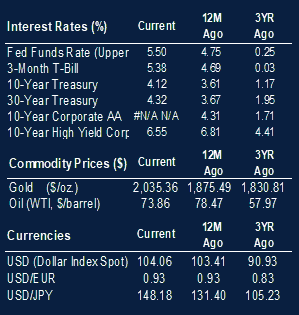

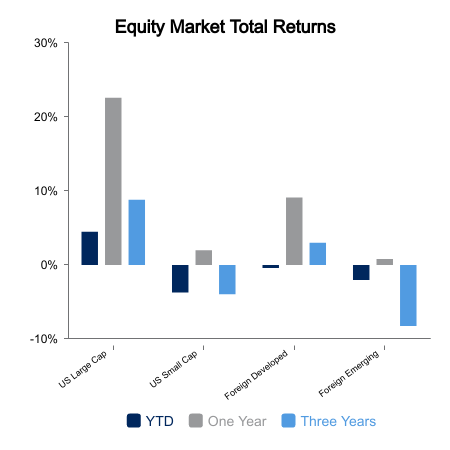

Stocks continued their year-to-date advance but lost a bit of steam after the S&P 500 Index came remarkably close to hitting the 5,000 level for the first time. Year-to-date this market’s weighted benchmark is up 4.1% led by firms in the semiconductor, internet media and streaming service providers.

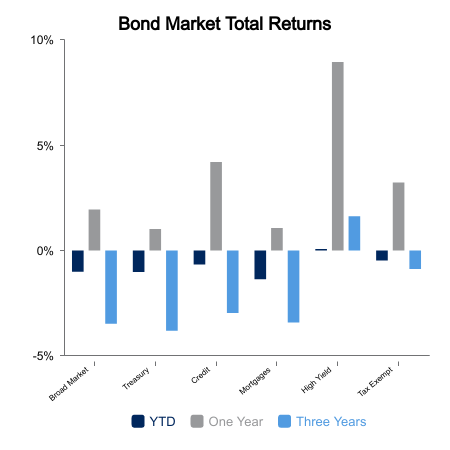

Longer-dated bonds underperformed with the Treasury getting ready to issue more debt after this week’s successful auctions which were at record levels.

This week saw reports of stronger economic data including reports on unemployment and ISM data that suggest employers are still holding onto their workers and the economy remains resilient.

Headline nonfarm payrolls increased by 353,000 in December and the unemployment rate held steady at 3.7% for a third consecutive month. Even the revisions of previous reports showed the second half of 2023 was hotter than was apparent in real time.

This suggests that upward pressure on wage growth will persist and has removed the likelihood of a Fed rate cut this quarter.

The headline ISM Manufacturing PMI, a measure of U.S. factory activity, increased to 49.1 in January from 47.1 but remains in contractionary territory. This jump appears to have come from firms placing new orders to replace inventory that had been declining over previous months. Still, manufacturers remain cautious as only four of 13 industries reported growth in January.

Improvement in the month’s ISM Services activity gauge aligned with the strong payroll report, reflecting stabilization in the services sector, however, parts of the report remain mixed. The index beat estimates as it rose to 53.4 in January versus a consensus expectation of 50.5. This reading reversed the declines that were seen in the prior two months. Like the improved orders seen on factory floors, backlogs of new orders helped advance this measure as firms met the added demand through additional output instead of using inventories. Survey participants noted rising transportation costs and scheduling issues due to “unrest in the Red Sea” for pushing costs higher.

Hawkish remarks from Fed Chair Powell noted here last week were affirmed by the strong economic data this week, effectively taking a March cut of the Fed Funds Rate off the table. Now, May has become the earliest date for the next Fed rate move. Bond markets responded to an outlook where interest rates stay higher for longer by pushing the U.S. Treasury 10-year yield from 3.88% to 4.12%. This sent broader bond market returns down by 1.41% pushing the year-to-date results into negative territory.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED