This past week saw the release of several economic reports geared toward the consumer

On Tuesday, the U.S. Bureau of Labor Statistics released its Consumer Price Index (CPI) for January. CPI rose 0.5%, in-line with expectations while above its 0.1% increase in December. Overall, CPI increased 6.4% year-over-year (YOY) which was its smallest increase since October 2021.

While the markets continue to view peak inflation in the rearview mirror, inflation nonetheless appears to remain ubiquitous.

One sub-component of CPI is the food index, specifically the food at home index which increased 11.3% YOY. Cereals and bakery products rose 15.6% YOY while dairy and related products rose 14.0% YOY. It appeared to be cheaper to eat out over the last year as the food aw ay from home index rose 8.2% YOY while the index for full-service meals increased 8.1% YOY.

The CPI report

The CPI report dovetailed into Wednesday’s report by the U.S. Department of Commerce regarding Retail Sales, which increased 3.0% in January, well above an estimated increase of 1.7% and followed December’s decline of 1.1%.

A separate aspect of this report is the retail sales control group, which includes all U.S. retailers, except for food, cars, construction materials and motor fuel.

This control group also rose 1.7% in January, exceeding estimates of 0.8% and a decline of 0.7% for December.

While it may appear the consumer is continuing to spend in the face of persistent inflation, the question remains, “Is the rate of consumer spending sustainable?”

Hourly wages increased 0.3% during January versus an estimated decline of 0.2%. While hourly wages grew 4.4% YOY, real wage growth has not kept up with inflation.

Small business owners

Small business owners may be becoming more skeptical regarding the overall economy. The National Federation of Independent Business released its Small Business Optimism Index for January, which increased 0.5 points to 90.3, which is well below its average of 98.0 since 1974.

While owners reported “job openings were hard to fill,” most owners expect real sales going forward to be challenging.

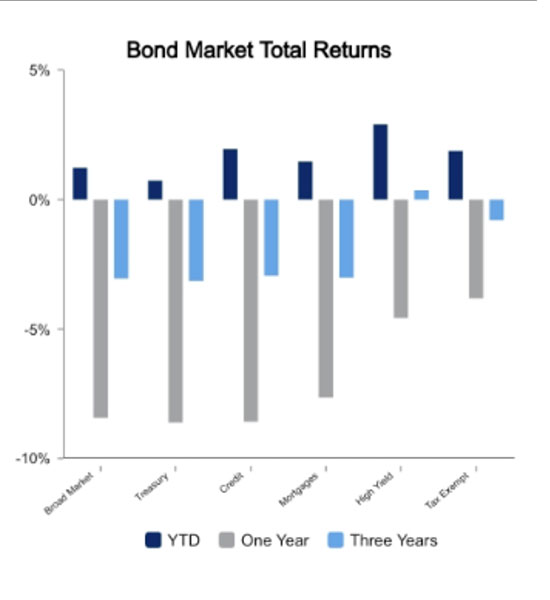

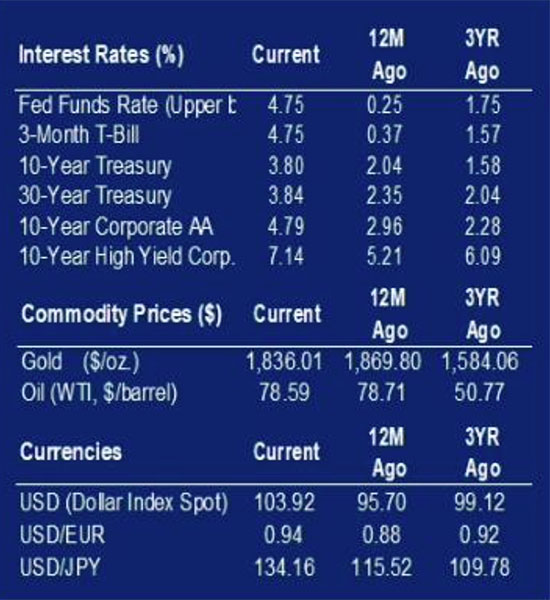

Interest rates increased across the yield curve over the last week. The yield on the 10-year U.S. Treasury is currently 3.8%, while the yield on the 2-year U.S. Treasury is 4.6%. This spread between the 2-year and 10-year stands at approximately 80 basis points (0.8%), the highest spread in 40 years.

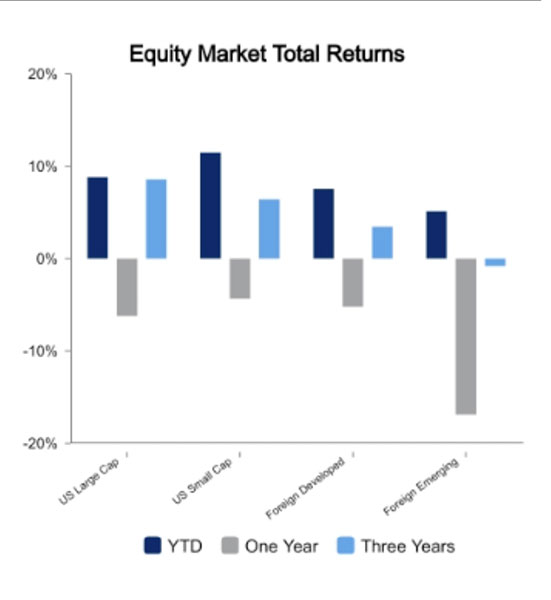

Equities continued their year-to-date uptrend over the last week. U.S. equities rose 0.4% while foreign equities rose 0.3%. Stay tuned.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED