As traders turn off their screens and head for the doors for a long weekend

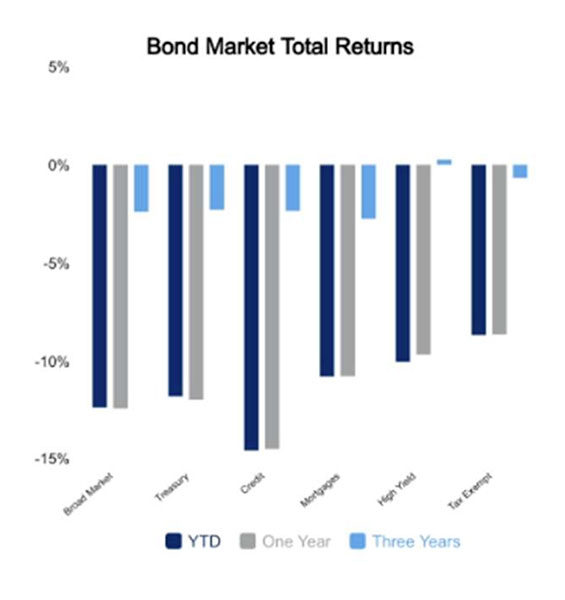

Market data was full of mixed signals. Mister Market was more Krampus than Santa Claus this week sending both bonds and stocks lower -1.2% and -2.9% respectively. This drawback follows strong gains for the quarter that still list bonds ahead +2.9% return and stocks up +8.6%.

The housing market has caught a winter chill

Since our last writing the housing market has caught a winter chill.

Sales of previously owned U.S. homes fell for the tenth straight month in November, extending a record decline brought upon by higher mortgage rates that continue to stifle affordability.

The National Association of Realtors reported that new contract closings decreased 7.7% in November, the most since February, to an annualized pace of 4.09 million. This drop in sales, which extends the longest string of declines back to 1999, underscores the impact high mortgage rates are having. The deep freeze has both buyers and sellers sidelined.

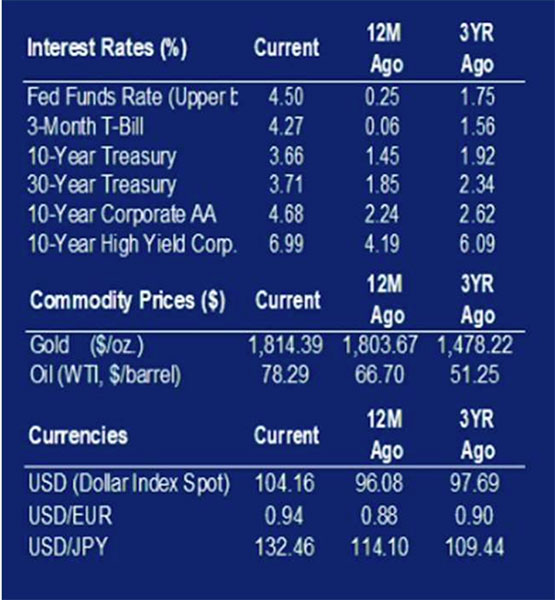

Rising mortgage rates that have doubled from a year ago slow buyers, while sellers are unwilling to give up their low-rate mortgages to double up their cost for less than double the house.

Applications to build homes, a proxy for future construction, decreased in November by 11.2% due to the same reasons noted before. It has been a challenging environment as the high cost for labor and construction materials has put pressure on builders trying to preserve margins.

An upward revision

The last reading of third quarter real Gross Domestic Product (GDP) brought an upward revision to an annualized rate of 3.2% reflecting upward revisions to consumer spending and business investment.

Inflation-adjusted GDP, or the total value of all goods and services produced in the economy, was boosted by a strong showing of personal consumption that advanced 2.3% compared to 1.7% forecast.

Strong labor market and wage growth continue to support spending momentum into 2023.

December’s improvement of the Conference Board’s consumer confidence measure to 108.3 from last month’s 100.2 shows the recent reprieve from consistently high inflation on household budgets.

Deflationary forces in the goods sector continue to run up against sturdy services inflation. Underlying the reading were mixed signals about the economy. While consumers see jobs as plentiful, fewer of them expect their incomes to increase.

This may explain the downshift of November retail sales.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED