Equity Market Strength Continues

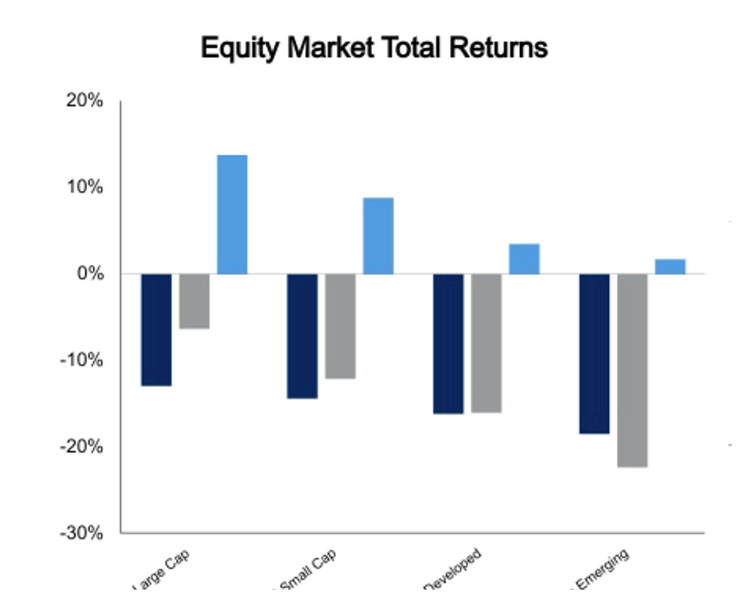

Stocks moved higher this week with the Russell 3000 Index returning 6.2%.

This week’s strong showing was a major contributor to the 10.3% return that has been generated since the start of the third quarter. Equity markets outside the U.S. were also higher for the week as the MSCI ACWI ex U.S. Index returned a more modest 0.8%.

Accompanying the positive returns from equities was a decline in volatility as the CBOE Market Volatility Index moved lower, a trend that has been in place since mid-June.

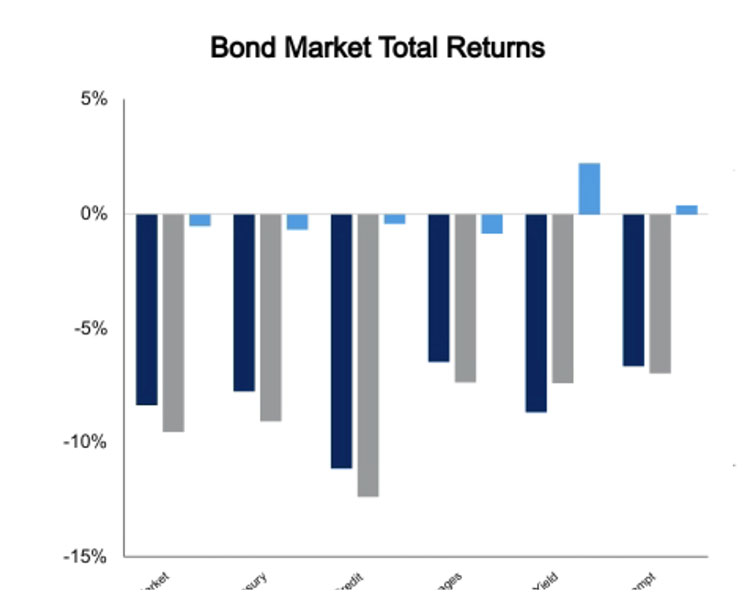

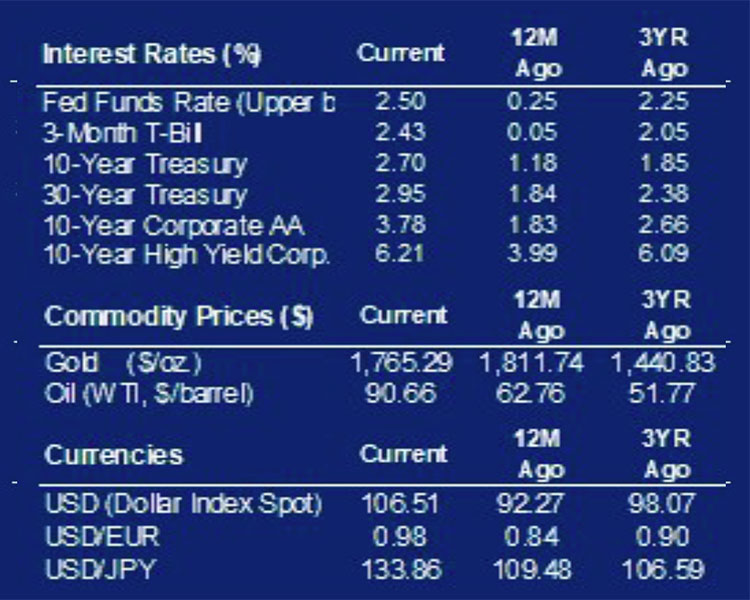

Bonds also saw positive returns over the one-week period moving higher by 0.5%. This was driven by a small decline in yields as the 10-year U.S. Treasury moved from a yield of 2.78% to 2.73%.

Conversely, shorter term yields, as measured by the two-year U.S. Treasury, moved higher with its yield rising from 3.02% to 3.07%.

GDP Report Highlights Economic Releases

The first estimate of U.S. GDP for the second quarter was released and, for the second consecutive quarter, it showed a decline. The 0.9% decline was driven in part by a decrease in inventories which subtracted two percentage points from the total. Consumer spending, which accounts for almost 70% of GDP was only modestly higher for the period rising just 1.0%.

In addition to the second quarter GDP report the week saw ISM survey data for the month of July released. The results for both the manufacturing and services sectors currently indicate the economy continues to grow as both exceeded the 50.0 threshold that indicates growth or contraction. Not only did both data points exceed the 50.0 level they were also higher than consensus expectations.

The U.S. consumer, as measured by the University of Michigan’s Consumer Sentiment Index, continues to be somewhat subdued as this week saw the index register a level that was just marginally higher than its all-time low which occurred the prior month.

A subindex which evaluates how consumers view prospects for their own financial situation, the general economy over the near term, and the economy over the long term continued to weaken, hitting its lowest level since May of 1980.

Second Quarter Earnings Update

With approximately three quarters of Standard & Poor’s 500 Index companies reporting, a majority of them have exceeded expectations on both the earnings and revenue fronts.

ot surprisingly, given the strength in natural gas and oil prices, energy companies have delivered the strongest results for sales and earnings. And with 92% of its index constituents reporting the financials sector has seen the weakest earnings performance.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED