Earnings for the first quarter are currently 7% higher than expected.

This comes amid slower growth than in previous quarters.

Overall, earnings are up 8.38% and the energy sector has contributed the most to this growth. Earnings are expected to grow by over 200% for the quarter.

However, performance of companies in the financials sector has been a drag on earnings this quarter.

Sales are coming in stronger than earnings which partially reflects the impact of increasing prices. The sales growth of 11.61% for the quarter is 2% better than expected.

Sales have also been led by the performance of energy companies. The expectation is for some margin compression as companies deal with increasing costs.

Lighter Durable Goods Orders

– Preliminary readings show durable goods orders coming in lighter than expected.

– March saw growth of 0.8% when 1.1% was expected.

– However, the increase over February was led by transportation equipment, up five of the last six months.

Consumer Confidence Wanes

Consumer confidence was down a bit in April from March. The Conference Board recorded a Consumer Confidence number of 107.3, which is lower than the expected 108.4 and the previous month’s 107.6.

Inflation and the Russia-Ukraine war have weighed heavily on consumer confidence. Vacation plans for the year have cooled as many react to increased travel costs, primarily associated with the sharp rise in the price of gas.

Is Housing Normalizing?

There is indication that housing is normalizing after the frenzy of 2020 and 2021. Pending home sales fell by 1.2% in March.

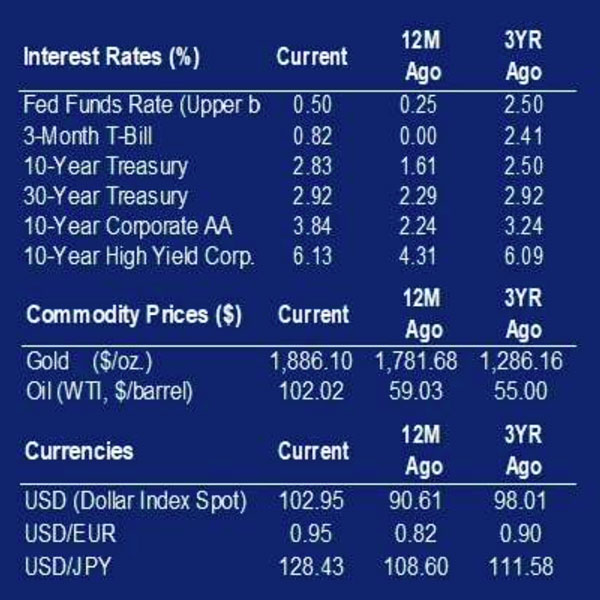

Demand for homes is still high but the ability to purchase for many has been negatively impacted by increasing mortgage prices, according to the National Association of Realtors. Year-over-year, home prices are up 31% after accounting for higher mortgage rates and price appreciation of houses.

New home sales were a little lighter than the expected 767,500 at 763,000. This is a drop from February’s 835,000. The decline of 8.6% is not necessarily indicative of a decline in the demand for housing. Demand is still strong, just not as strong.

The number of building permits issued in March was only 3,000 off of expectations. The report of 1,870,000 permits is slightly lower than last month’s.

Positive Economic Growth Indicator

Preliminary results for the Purchasing Managers’ Index show manufacturing coming in better than expected at 59.7 and services lighter at 54.7. These leading indicators show purchasing managers expect economic growth to continue.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED