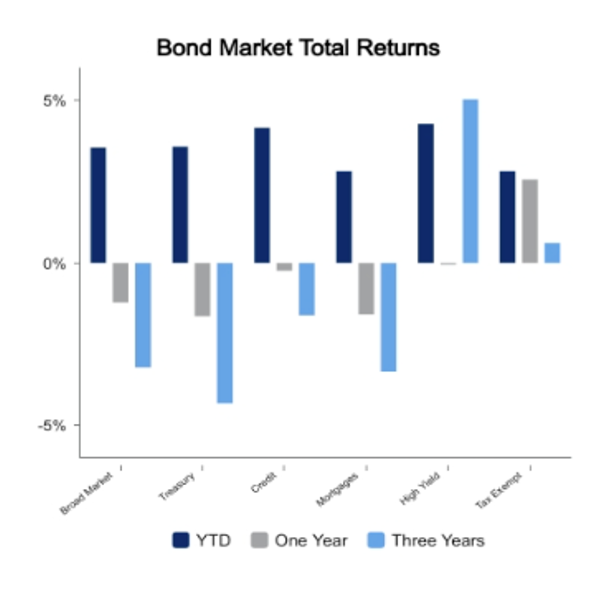

This past week bond markets advanced 0.7%, led by treasury issues as declines across the yield curve boosted prices. This week’s advance pushed the year-to-date return on the broader bond market to +3.46%.

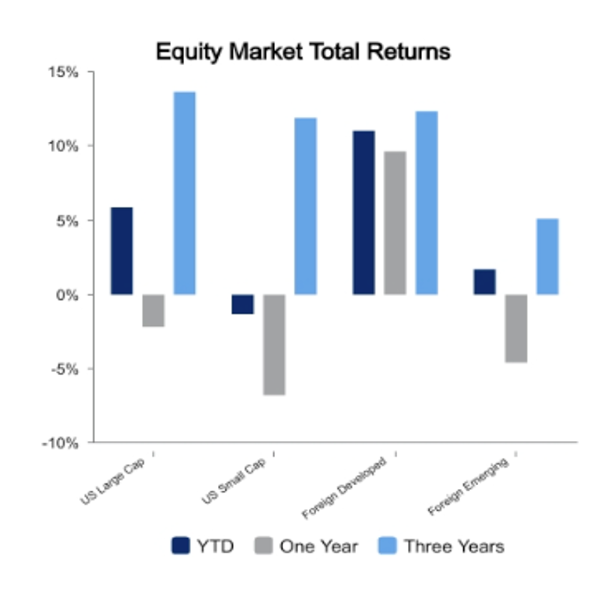

Contrary to this advance, stocks dropped this week by -2.0% to +5.4%, cutting the progress equity markets have made this year.

Given recent earnings announcements it’s not surprising that financial and telecom companies led the downturn in which 10 of 11 sectors declined in value. The recession-proof consumer staples sector proved to be the only one to report an advance.

Declining Economic Conditions

The stock market decline occurred with a backdrop of three Federal Reserve regions reporting weaker than forecast economic conditions. Further, the Conference Board released its report on leading economic indicators that showed a -1.2% decline, the twelfth monthly decline in a row.

A bright spot this week came from the latest S&P CoreLogic Case-Shiller National Home Price Index that rose 2.05% year-over-year. This was, however, the smallest gain since 2012.

Depending on where you live, home price changes contrasted significantly with the Southeast (+7.8%) remaining the country’s strongest region, while the West (-4.2%) continues to be the weakest.

Consumer Uncertainty

A consequence of recent banking turmoil is heightened uncertainty which has led to a drop in the Conference Board’s measure of consumer confidence to 101.3 in April from 104.0 the prior month.

The pullback was influenced by the portion of the report that reflects on consumers’ six-month outlook. Expectations of a tighter supply of credit and a more pessimistic outlook for employment and business conditions drove the report lower.

Consumers are more optimistic about current conditions as respondents surveyed felt that jobs remain plentiful.

Debt Ceiling Standoff

Investors remain concerned with the potential economic headwind created by Congress as it prepares to have yet another standoff regarding the debt ceiling that imposes a limit on the Treasury’s total borrowing.

A long history back to 1917 points toward a high probability of the bill passing, but a look at the past also reveals the disruption a delay of passage can create. In late 1995 and early 1996 the disputes caused two shutdowns of the federal government.

Another fight in 2011 rattled financial markets prompting Standard & Poor’s to issue the first-ever downgrade of the U.S. government’s credit rating.

While the impact on markets is quite broad, the clearest example is Treasury bills maturing after the expected June date when government payments are likely to be disrupted, trading near a 5% yield while May issues currently yield under 4%.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED