Inflation continues to run hot. The Consumer Price Index (CPI) for March was released this week.

The increase of 8.5% over the year and 1.2% from February to March shows a continuation of price increases. A lot of this increase can be attributed to sharp rises in energy.

Fuel oil was up 22.3% and gasoline, up 18.1% over the month, contributed to an increase of 11.0% in the energy segment of the report. From last year, fuel oil and gasoline were up 70.1% and 48.0%, respectively.

Prices for used cars were the only major decline in the month, down 3.8%.

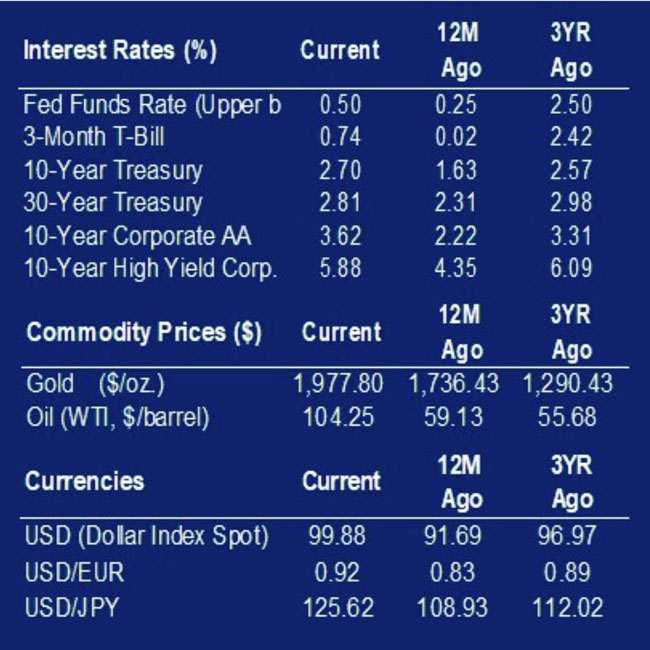

CPI excluding food and energy was up 6.5%. The high inflation number increases the likelihood of more aggressive Federal Reserve action. The probability has increased for a 0.50% raise at the Federal Open Market Committee May meeting.

Declining Consumer Buying Power

Despite a strong increase in hourly earnings in March, the data point was unable to keep up with the increase in prices. Year‐over‐year, hourly earnings grew by 5.6% in March. Month‐over‐month, it is up 0.4%. Real hourly earnings, after adjusting for inflation, are down 2.7% from March 2021.

Consumers may be taking on more debt to offset the decline in their buying power. Consumer credit increased significantly in February. The credit increase to $41.8 billion is a jump from the prior month’s $8.9 billion and higher than the expected $17.5 billion.

30‐year Mortgage Rates

30‐year mortgage rates broke 5% this week. The average 30‐year mortgage has stayed under 5% since 2011. The increases reflect the rising costs of capital.

Earnings Season

We are at the very beginning of earnings season. Only 7% of S&P 500 companies have reported. Earnings are coming in a little better than expected with initial growth of 6.3%.

This is 9.5% better than expected. Sales are growing 1.9% better than expected at 10.9%.

The faster pace of sales compared to earnings indicates the potential for narrowing margins as costs increase. However, it is still early, and the pace may change as more reports come through.

Equity Markets

Equity markets are down this week and the S&P 500 lost 0.73%. The losses were led by information technology, down 2.57% and communication services, down 2.51%.

The energy sector continues to be a strong performer, up 4.08% this week.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED