As inflation measures climbed over 2021 to levels not seen in decades…

… there was a rush by some to project the heightened levels would continue into the foreseeable future.

Even Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen recently stated the term “transitory” should be retired when discussing the outlook for inflation in the United States.

“Transitory” was meant to indicate the current spike

While Chair Powell has acknowledged that inflation is taking longer than originally expected to peak and begin a trajectory toward pre-pandemic levels, he adds some context in that the use of the term “transitory” was meant to indicate the current spike in inflation would not lead a long-term scenario of continuous price increases.

We continue to feel that, like Chair Powell, the current bout of inflation will not leave a permanent mark on the economy, but we also agree that inflation has reached levels that weren’t widely anticipated a year ago and concede that it is taking longer than originally anticipated to start a decline.

So, if inflation can’t accurately be defined as “transitory” then what is the appropriate term to define the current increase and prospective future moves in price levels?

The word we feel best describes the scenario that will unfold as we progress through 2022 is “transitory-ish.”

The use of the word “transitory-ish” is used to indicate that, while the rate of inflation has accelerated more quickly than originally expected, we continue to anticipate that as 2022 progresses the rate of inflation will decline.

The decline may very well not take the level to an annualized rate of 2.0% or lower but will move meaningfully in that direction.

Moderating inflation this year

There are several reasons for our outlook of moderating inflation this year. The first is a reduction in the rate of money supply growth.

Among economic circles it is a commonly held belief that an excessive level of growth in the supply of money will lead to an increase in inflation. The higher rate of inflation does not happen simultaneously with an increase in money supply but occurs with a lag.

For example, the weekly growth of M2 (a standard measure of money supply) accelerated sharply in early 2020 (see graph above). This coincides with a massive transfer of cash to citizens as part of the legislative effort to offset the negative economic impact brought on by the COVID pandemic.

Since the early part of 2021 however, the year-over-year rate of weekly growth of M2 has shown a material decline. The 2020 increase was a precursor to the higher inflation seen in 2021.

Given the decline in the rate of growth of M2, we anticipate the course of inflation will reverse and move meaningfully lower in 2022.

Declining inflation in 2022

Another basis for our expectation of declining inflation in 2022 is by looking at what the financial markets are telling us.

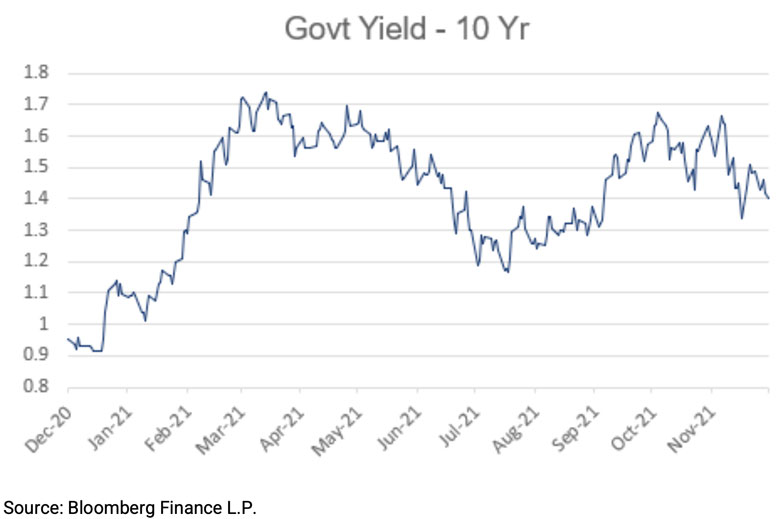

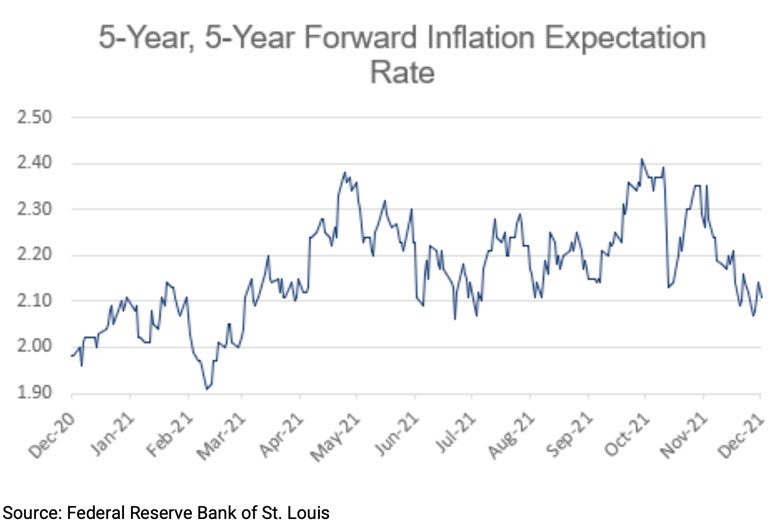

In November the 10-year U.S. Treasury note sat at a yield of 1.47% (see graph above). The yearly high thus far in 2021 is 1.74%. A yield sitting over 25 basis points lower than its peak level of the year does not seem to suggest a bond market overly concerned about higher inflation becoming a deep- seeded attribute of the future market environment. A second indication of financial market inflation expectations is the Five-Year, Five-Year Forward Inflation Expectation Rate (see graph below).

This measure reflects expected inflation (on average) over the five-year period that begins five years from today. The current level for this forward- looking measure is 2.19%, not really indicative of a perceived long duration bout of higher-than-target inflation.

The final piece of our moderating inflation outlook pertains to the unsnarling of supply chains. Strong demand for goods occurred during the peak of the pandemic as consumers, infused with additional funds from various government programs, spent aggressively.

Meanwhile the production of goods was deeply constrained by a COVID- related slowdown in manufacturing which led to increased prices for numerous products.

The inability to transport finished products to consumers in a timely manner was also a major contributor to upward pressure on prices as supplies on the shelves of retailers were deeply constrained.

While there continues to be a significant number of ships waiting to be unloaded at Southern California ports, numerous signs indicating that pressure is easing can be seen. First, the ports typically experience a slowdown in the number of ships to unload during the first quarter.

Don’t fall behind!

Stay informed on what’s happening today that might affect your tomorrow.

Delivered weekly, straight to your inbox.

This, combined with increased productivity at the ports, should lead to goods being unloaded off ships more quickly. Second, rail dwell times are declining. Rail dwell time is the amount of time cargo waits on the docks to be picked up and taken to its ultimate destination.

For the port in Los Angeles this figure has declined from 13.5 days during the summer to two days as of December. 16. Truck dwell time has also seen improvement from 11 to six days.

And lastly, volumes are potentially somewhat pulled forward as inventories are being rebuilt quickly ahead of temporary factory closures in China due to the Lunar New Year on February 1.

In addition to the improving signs on the supply front support should also be seen on the demand front given the heightened purchases of goods made during the peak pandemic period which will lead to a level of more modest goods purchases in the future.

As we proceed into 2022

We fully anticipate inflation will begin to trend lower. This is our base case, but we readily acknowledge that inflation may not decline as we currently expect.

If that scenario develops, we will reassess and adapt our outlook, and our portfolio positioning, accordingly.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations, and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.

Content prepared by: Jon Augustine, CFA, Chief Investment Officer

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED