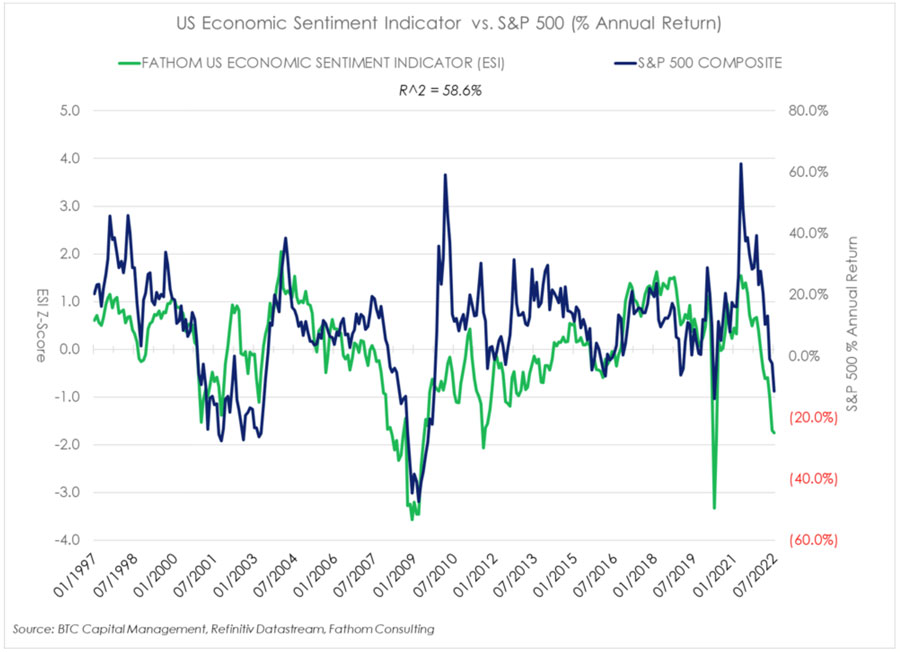

1. U.S. Economic Sentiment Indicator vs. S&P 500

This chart exhibits the Fathom Consulting’s Economic Sentiment Index (ESI) relative to the subsequent 12 month percentage change in the S&P 500.

Fathom’s ESI measures economic sentiment, and employs a technique known as “principal component analysis” to distil information from numerous consumer and business surveys into a single composite indicator exhibiting economic growth.

The Z-score for the ESI is depicted above to measure the standard deviations from the mean. A Z-score of 0 indicates the data point’s score is identical to the mean score. A Z-score of +/- 1.0 indicates a value that is one standard deviation from the mean. Scores may be positive or negative, with a positive value indicating the score is above the mean and a negative score indicating it is below the mean.

R-squared (R^2) acknowledges the relationship of movements in the S&P 500 that may be explained by movements in the ESI.

ESI may be considered as a leading indicator regarding next 12 month performance of the S&P 500. Subsequent annual performance of the S&P 500 tends to mimic the trend in the ESI.

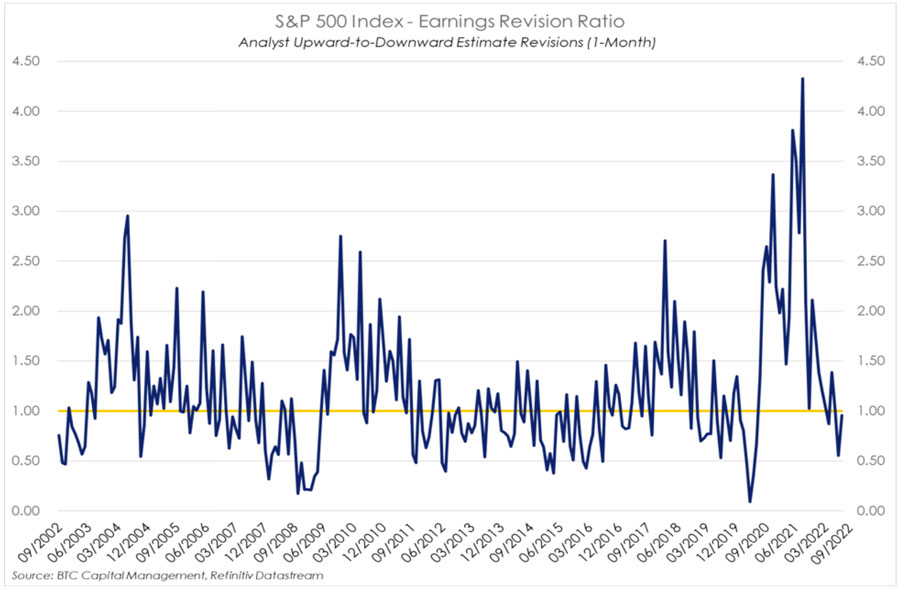

2. Earnings Revision Ratio

Earnings revisions by analysts have been front of mind, specifically when attempting to ascertain expectations for valuations and overall return.

This chart exhibits the trend in analysts’ one-month earnings revisions, which has been fluctuating throughout the first half of 2022. Analyst revisions have trended downward throughout the first half of 2022. This phenomena has continued into the current quarter and beyond.

With the third quarter reporting season just around the corner, analysts have been active in revising their estimates. According to Refinitiv IBES, for the S&P 500 analysts are estimating year-over-year (YOY) growth in earnings for the third-quarter of 5.1%, materially below the 11.1% estimated as of the beginning of the quarter. Likewise, for the fourth quarter analysts are estimating earnings will grow 6.3% YOY versus 10.6% as of the beginning of the quarter.

Looking out over the next 12 months, downward revisions currently outpace upward revision 62% to 38%, a trend which has been in place for much of this third quarter. The result, analysts are estimating earnings growth YOY of 7.9% for all of 2022 and 8.0% for 2024, down from 9.5% and 9.3% as of the beginning of the quarter.

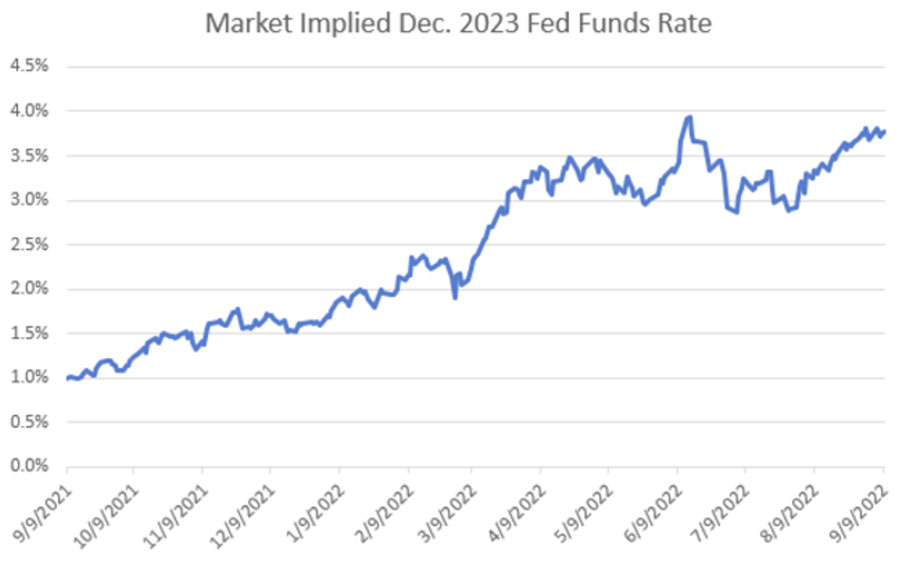

3. Higher For Longer

The market is removing the concept of rate cuts in 2023.

FOMC Chair Powell gave an extremely direct and hawkish message at Jackson Hole.

The Fed is saying they will tolerate more economic pain to beat inflation.

However, growing evidence shows the Fed is limited against aggressive fiscal spending.

The global energy crisis remains unresolved, thereby keeping upward pressure on inflation.

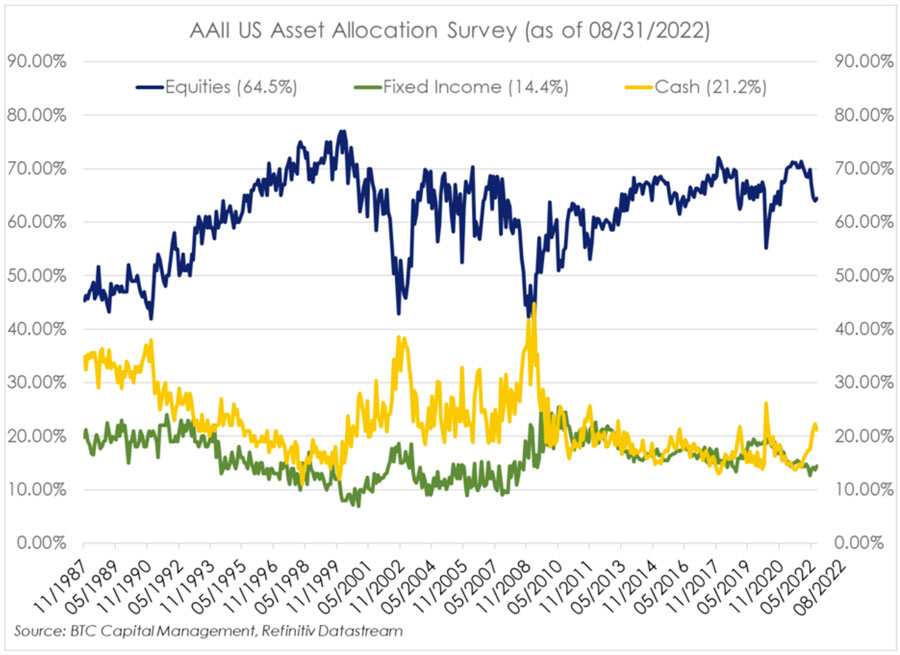

4. AAII U.S. Asset Allocation Survey

This chart presents the American Association of Individual Investors (AAII) US Asset Allocation Survey, a monthly survey of investors.

Investors appear to have favored cash as a means of managing risk. The allocation to cash (21.2%) began to accumulate as of the end of the second quarter. As of Dec. 31, 2021, the allocation to cash was similar, modestly higher, to that of fixed income (15.1% and 14.4%; respectively).

Investors appear to have retained an appetite for equities as equity allocations, currently 64.5%, have remained somewhat firm since year end (70.5%). Overall, commitments to equity investments is currently above the historical average of 61.6% since November 1987.

The allocation to fixed income has remained static since Dec. 31, 2021 (14.4%). Since November 1987, the allocation to fixed income has exhibited a range from a minimum of 6.9% to a maximum of 25.5%, with an average allocation of 15.9%.

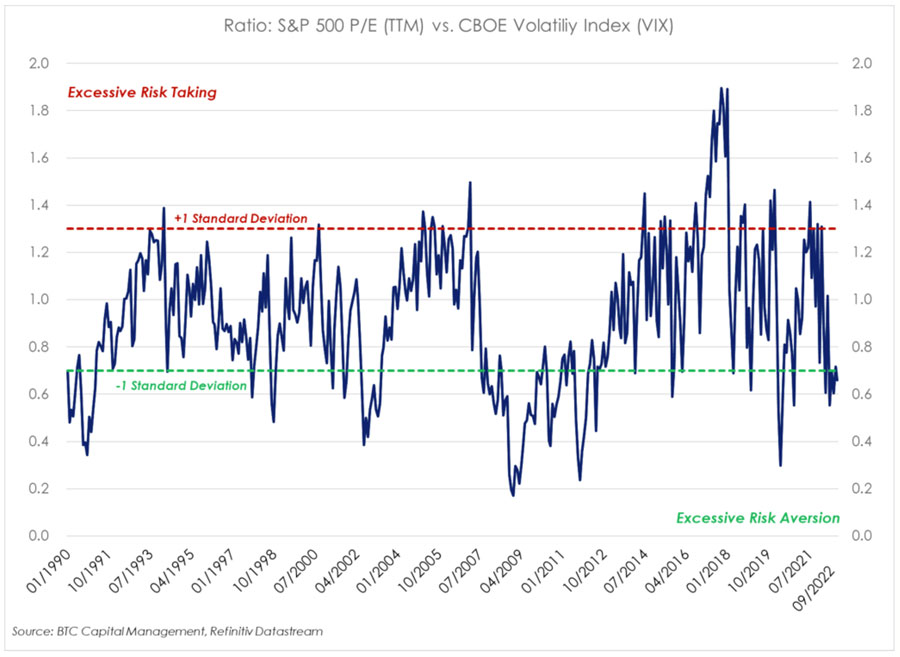

5. Ratio: S&P 500 P/E CBOI Volatility Index

This chart presents a ratio of the trailing 12-month price-to-earnings ratio (P/E TTM) of the S&P 500 to the CBOE Volatility Index (VIX).

The CBOE Volatility Index (VIX) is designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, as represented by the S&P 500.

The chart presents +/- 1 standard deviation of the ratio from its average since 1990, to identify excessive risk taking or aversion.

Excessive risk taking is acknowledged when the ratio exceeds +1 standard deviation. Excessive risk aversion (avoidance of risk) is acknowledged when the ratio is below -1 standard deviation. Note this is one of many measures that may be considered in managing risk and or pursuing return.

Currently this ratio implies excessive risk aversion which may appear to be somewhat counterintuitive, given the expectation for higher interest rates, current valuations, analyst downward revisions to earnings, and questions concerning the economy (in general).

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED