This Month’s Five in Five covers the following topics:

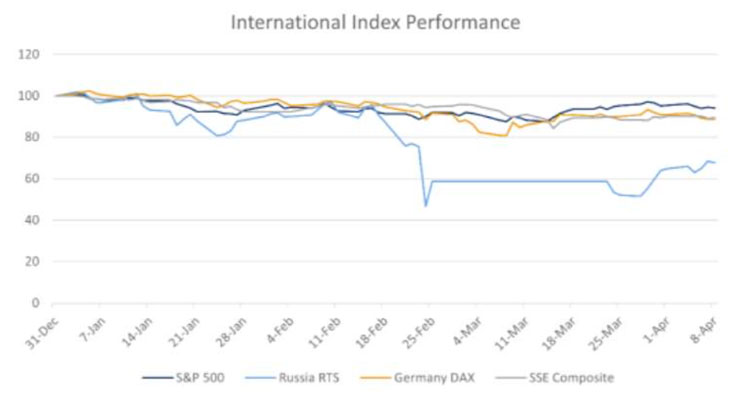

1. International index performance

- As of April 8, the S&P 500 Index is down 6.4%, the Russia RTS Index registers -33.5% year-to-date, the German DAX Index has declined 10.8%, and Shanghai’s SSE Index is down 10.5%.

- Performance did show improvement in March as broad global indices rose.

- The Russia-Ukraine conflict has weighed heavily on European stocks.

- Shanghai stocks have been negatively impacted by recent COVID lockdowns.

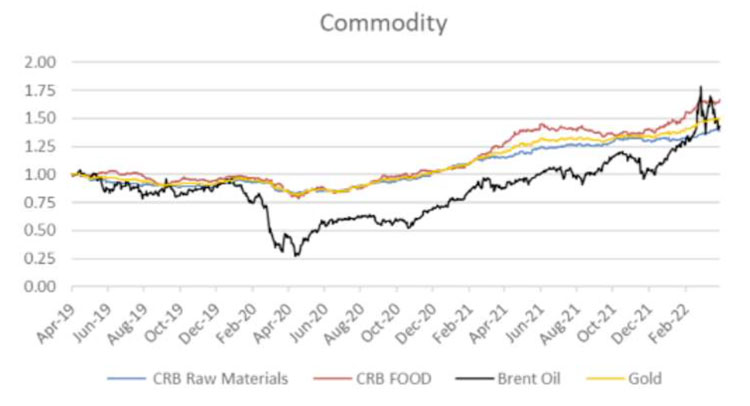

2. Three year look at commodity prices

- Commodity prices have risen steadily since the pandemic lows in mid-2020.

- While all commodities have moved higher since year-end 2021, oil and food showed the highest rates of acceleration.

- Supply as well as demand is impacting commodity pricing.

- Gold, a traditional inflation hedge, has shown only a modest price increase in the current elevated inflation environment.

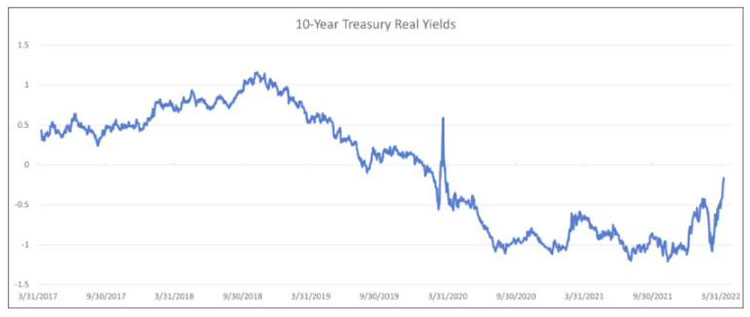

3. Real yields surge

- 10-year real yields are up more than 80 basis points in 20 days.

- In the past 15 years, the only larger moves were in 2008 and 2013.

- This will slow the real economy with a lag.

- The 2008 and 2013 spikes marked the peak as the Fed remained or increased accommodation.

- This time, the Fed has been outspoken about continuing to tighten financial conditions.

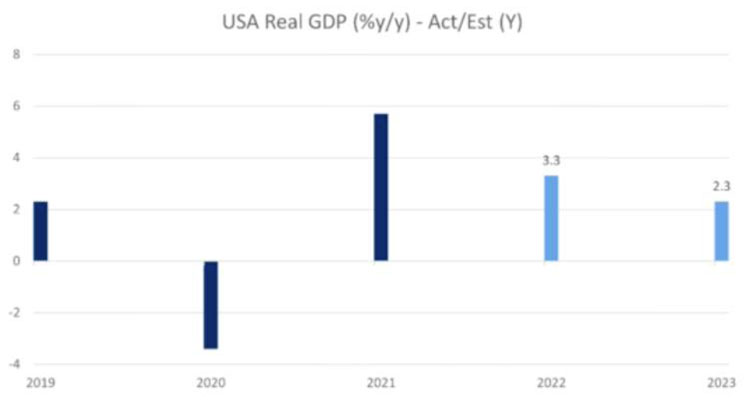

4. USA real GDP

- Despite the uncertainty created by Russia’s invasion of Ukraine, high inflation and COVID lockdowns in China, economic growth is anticipated in 2022 and 2023.

- As illustrated the growth is anticipated to decelerate relative to the strong recovery experienced in 2021.

- Globally, the International Monetary Fund is expected to reduce its 2022 outlook for global economic growth in its updated forecast to be released later this month.

- Changes in monetary policy will play a significant role in the trajectory of future growth.

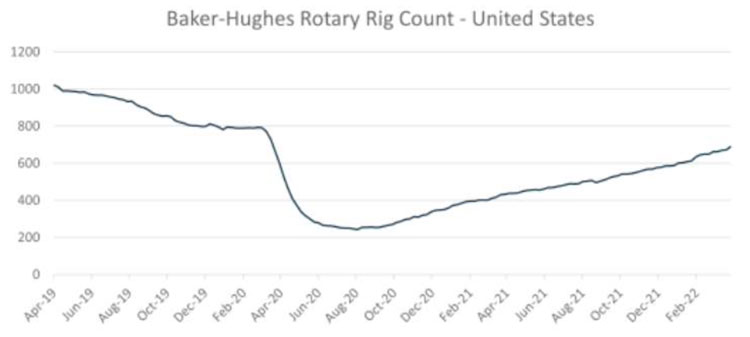

5. Rotary rig count

- Despite steady growth, the U.S. oil industry rig count has not recovered as fast as the broad economy post-2020 recession.

- There has not yet been a strong increase in industry capital expenditures (CapEx) reflecting the increase in oil price.

- Companies are hesitant to increase CapEx spending rapidly in case there is a drop in oil prices.

- Despite company concerns regarding future price strength demand for the oil is expected to increase in the next few

years.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED