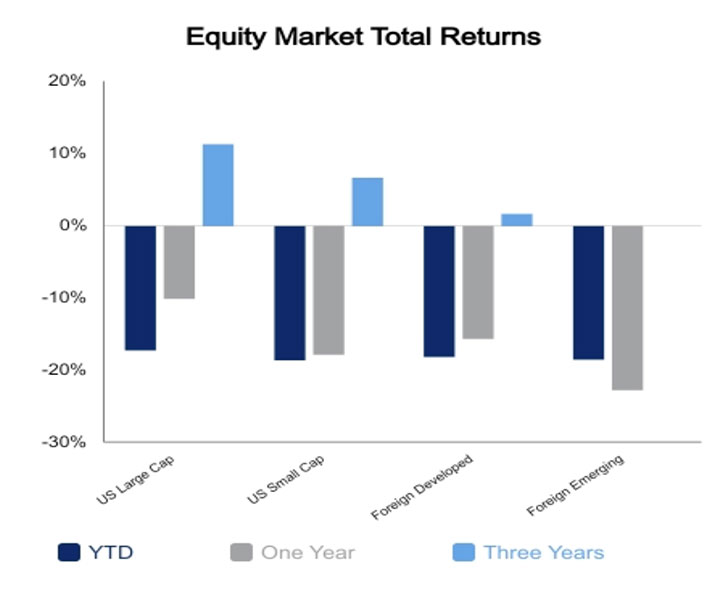

This past week equities provided some relief to an otherwise abysmal year.

Domestic equities advanced +4.1%, with large caps increasing +4.0% while small caps rose +5.4%. Outside the U.S., foreign equities increased +5.0% as developed markets rose +4.9% and emerging markets eked out an upward move of +1.5%.

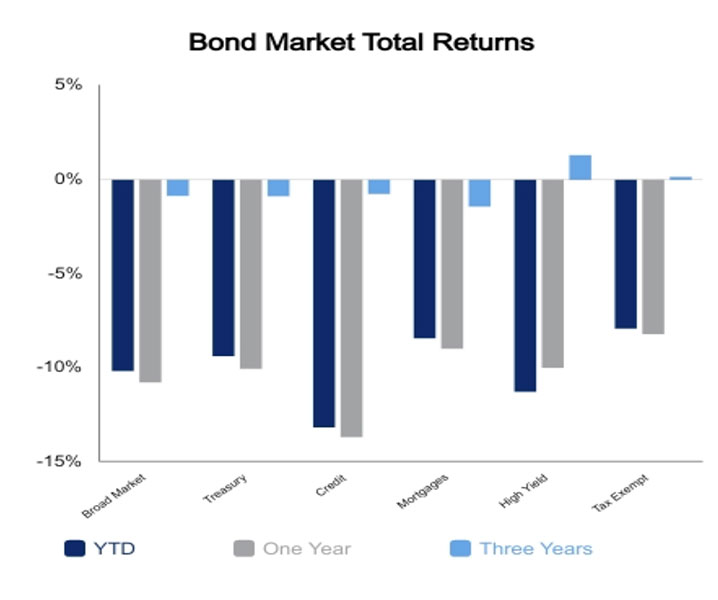

Rise in Interest Rates

Yields also retraced over the last week.

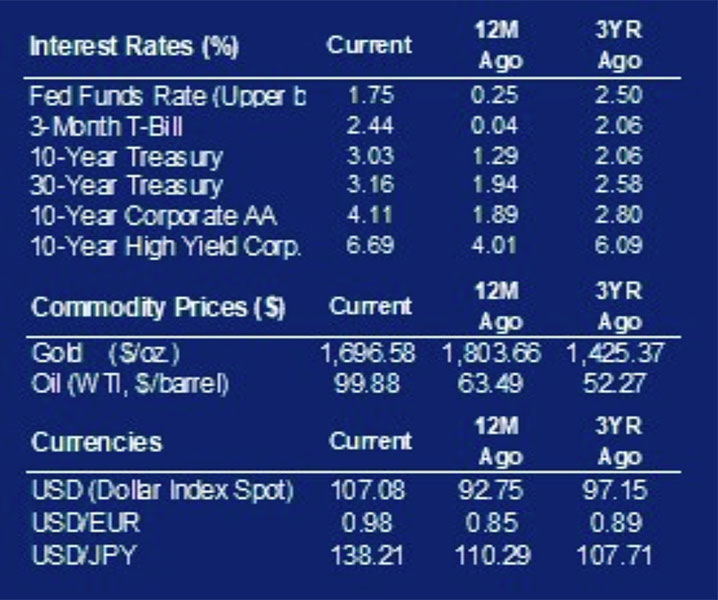

The yield on the U.S. 10-year Treasury rose to 3.03%. Given this rise in interest rates over the last week, Value outperformed Growth, +4.4% versus +3.8%. A rise in rates typically stalls growth-oriented companies, whose realization of earnings may be long in duration.

Investors are monitoring earnings announcements, as a number of bellwether companies have reported mixed results for the quarter just ended.

Housing Sector Reports Released

Several reports related to the housing sector were released over this past week. Housing continues to be beleaguered.

The U.S. Census Bureau reported building permits for June at 1,685,000 modestly higher than consensus estimates of 1,680,000.

This report was tempered by housing starts for June, which came in at 1,559,000, lower than consensus estimates of 1,585,000. Housing starts for June declined -2.0%, which followed a downturn of -11.9% for May.

The National Association of Home Builders (NAHB) Housing Market Index also surprised to the downside. This survey asks home builders to rate current conditions such as sales of single-family homes, prospects for sales activity, and traffic of prospective home buyers, then scores each component in structuring their index.

A score over 50 indicates that builders view sales conditions as good; below 50 indicates poor sales conditions exist.

The NAHB reported for July its survey result of 55 that, while over 50, was materially under consensus estimates of 65 and well below June’s survey of 67.

Sector Highs and Lows

Energy has been the best performing sector year-to-date, up +27.5%. That said, oil has been volatile since March, falling off its highs.

Over the last week, the spot price for West Texas Intermediate rose +6.2%, which advanced this sector’s performance by +6.6% over this time.

Earnings Season Forecast

We are in the second quarter earnings season.

According to Refinitiv, analysts estimate year-over-year growth in earnings of S&P 500 companies for the second quarter to have increased by +5.6%. Excluding the Energy sector, analysts anticipate earnings will contract year-over-year by -3.4%.

Concerning revenues, year-over-year growth is projected to be +10.8%, adjusted to +6.6% when removing the Energy sector. Thus, analysts are expecting positive revenue growth for the second quarter impacted by margin compression to reduce overall earnings-per-share.

Investment and Insurance Products are:

- NOT INSURED BY THE FDIC

- NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

- NOT A DEPOSIT OF OTHER OBLIGATION OF, OR GUARANTEED BY, HERRING BANK, OR ANY BANK AFFILIATE

- SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED